A subprime auto loan is a car loan designed for borrowers with poor or limited credit history, typically with a credit score between 580 and 619. Lenders consider factors like income, employment stability, and debt-to-income ratio when approving subprime borrowers.

Owning a car is more than just a convenience—it’s a necessity for millions of Americans who rely on their vehicles to commute, care for family, or simply live life on their terms. But what if your credit score isn’t perfect? Enter subprime auto financing, a pathway for those with less-than-stellar credit to still get behind the wheel. In this comprehensive guide, we'll break down everything you need to know about subprime auto loans, from understanding how they work to navigating your options wisely and protecting yourself from predatory lending.

Whether you’ve experienced bankruptcy, missed payments, or simply have limited credit history, this guide will help you explore car loan options for bad credit—and most importantly, how to choose a path that supports your financial health in the long run.

What is a Subprime Auto Loan?

A subprime auto loan is a type of financing offered to borrowers with low or poor credit scores. While the term “subprime” may sound negative, it simply reflects the borrower’s creditworthiness as assessed by lenders. Typically, subprime borrowers have FICO scores between 580 and 619, although different lenders may define ranges differently.

Subprime loans allow people with bad credit to purchase a vehicle, usually at a higher interest rate than someone with prime or super-prime credit. This higher rate compensates the lender for taking on additional risk.

According to Experian’s 2024 State of the Automotive Finance Market report, 17.9% of car loans were extended to subprime borrowers. That means subprime financing is common—and often necessary—for many Americans.

Subprime vs. Prime Auto Loans: What’s the Difference?

| Feature | Prime Loan | Subprime Loan |

|---|---|---|

| Credit Score Range | 660–780+ | 580–619 |

| Interest Rate | Lower (4–6%) | Higher (9–20% or more) |

| Approval Process | Easier terms | Stricter documentation |

| Down Payment | Often optional | Frequently required |

| Loan Term | Shorter | Sometimes extended |

If you’re wondering how to evaluate subprime vs prime auto loans, it boils down to understanding trade-offs. Subprime loans provide access, but typically at a cost. Still, they may be the best (or only) route for some buyers.

Who Needs a Subprime Auto Loan?

If your credit file shows:

- A FICO score under 620

- Past due accounts

- Limited or no credit history

- A recent bankruptcy or foreclosure

You may be considered a subprime borrower.

The good news? Approval is still possible—even for first-time car buyers with bad credit or those looking for a subprime auto loan with bankruptcy on their record.

How to Get a Subprime Auto Loan

1. Check Your Credit Report

Start by reviewing your credit report for errors. You can obtain free reports from AnnualCreditReport.com. Understanding where you stand is crucial before approaching lenders.

2. Compare Lenders

Not all subprime auto lenders are created equal. Look for reputable dealerships or financial institutions that specialize in auto financing for bad credit. Some dealerships offer subprime auto loans in-house, while others connect you to outside lenders.

3. Gather Your Documents

Most lenders will require:

- Government-issued ID

- Proof of income (pay stubs or bank statements)

- Proof of residence (utility bills or lease agreement)

- Vehicle insurance

- Trade-in documents (if applicable)

Knowing what documents are needed for a subprime auto loan will speed up approval.

4. Determine a Realistic Budget

Use a subprime auto loan calculator to estimate monthly payments, interest, and total loan costs based on your credit tier.

5. Prepare a Down Payment

While some lenders advertise bad credit car loans with no down payment, most will require a down payment—often 10% or more—to reduce risk. Larger down payments may also reduce your rate.

Subprime Auto Loan Requirements

Minimum requirements vary, but commonly include:

- Monthly income of $1,500–$2,000

- Valid driver's license

- Stable job or employment history (6+ months preferred)

- Debt-to-income ratio under 50%

- No recent repossessions (within 6–12 months)

Meeting these subprime auto loan requirements increases your chances of approval.

Subprime Auto Loan Interest Rates in 2025

Interest rates fluctuate based on credit score, vehicle type, loan length, and the lender. Here’s a rough breakdown for 2025:

| Credit Score | Average APR (Used Car) | Average APR (New Car) |

|---|---|---|

| 580–619 (Subprime) | 17% – 21% | 14% – 18% |

| 620–659 (Near Prime) | 10% – 14% | 8% – 11% |

Pro tip: Shorter terms = less interest paid overall.

Understanding the Risks: Pros and Cons of Subprime Auto Loans

Pros:

- Enables car ownership with poor or no credit

- Can help rebuild credit with on-time payments

- Options available even after bankruptcy or default

Cons:

- Higher interest rates and monthly payments

- More risk of negative equity

- Potential for predatory lending if not careful

Learn how to avoid predatory subprime auto loans by reading fine print, asking about fees, and checking for early payoff penalties.

Can You Refinance a Subprime Auto Loan?

Yes—and it can save you thousands. Once your credit improves, you may qualify for better rates.

Refinancing Tips:

- Wait 6–12 months of on-time payments

- Compare rates and fees

- Check if your loan has a prepayment penalty

Some borrowers worry, “Can I refinance my subprime auto loan early?” The answer is yes, but make sure you won’t be penalized for doing so.

Tips to Improve Your Credit Before or During a Subprime Auto Loan

- Pay all bills on time

- Lower your credit utilization

- Don’t apply for other new credit

- Consider a secured credit card

- Avoid overdrafts and bounced payments

Improving your score can open doors to better car loan options for bad credit or lower subprime auto loan interest rates.

Protecting Your Vehicle Investment

Since subprime borrowers often pay more interest and finance older vehicles, it's essential to protect that investment.

- Get comprehensive car insurance

- Consider an extended vehicle protection plan to help with repairs

- Ask about gap insurance

- Follow a routine maintenance plan

At Noble Quote, we help drivers protect their investment with premium vehicle repair protection. Check out our Learning Center to explore your options.

Take Control of Your Financing Journey

Subprime auto loans aren’t the end of the road—they’re a beginning. With the right plan, you can secure the car you need, rebuild your credit, and eventually transition to better loan terms in the future. Just remember:

- Do your homework

- Avoid lenders that seem too good to be true

- Prioritize loan terms and total cost over monthly payments

- And always protect your investment with solid insurance and warranty coverage

Ready to learn more about protecting your car and your wallet? Visit the Noble Quote Learning Center and discover how we help drivers like you stay on the road—confident and covered.

Frequently Asked Questions About Subprime Auto Loans: Honest Answers for Drivers with Bad Credit

What is a subprime auto loan and who qualifies for one?

Can I get approved for a car loan with bad credit?

Yes, many lenders specialize in bad credit auto loans. If you have a steady income and the right documentation, you may still qualify—though your interest rate may be higher than average.

How much interest will I pay on a subprime auto loan?

Interest rates for subprime loans vary but typically range from 14% to over 20%, depending on your credit score, down payment, loan term, and lender policies.

What documents do I need for a subprime car loan?

Lenders usually require a valid driver’s license, proof of income (like pay stubs), proof of residence, vehicle insurance, and possibly references or utility bills.

Can I get a subprime auto loan with no money down?

Some lenders do offer bad credit car loans with no down payment, but they often come with higher monthly payments or stricter loan terms. A larger down payment may improve your approval odds.

How long does it take to get approved for a subprime auto loan?

Approval timelines vary. Some lenders offer same-day decisions, while others may take 1–3 business days depending on your documentation and credit check.

Will a subprime car loan hurt my credit score?

A subprime loan can help your credit if you make on-time payments. However, missed or late payments can further damage your credit score.

What’s the difference between subprime and prime auto loans?

Prime auto loans are for borrowers with good to excellent credit (typically 660+), offering lower interest rates. Subprime loans are for borrowers with lower credit scores and usually have higher rates and stricter terms.

Can I refinance my subprime auto loan for a better rate later?

Yes. If your credit score improves or interest rates drop, you may qualify for refinancing with better terms after 6–12 months of consistent payments.

How can I avoid predatory lenders when getting a subprime loan?

Stick with reputable lenders, compare offers, read loan agreements carefully, and avoid loans with prepayment penalties or hidden fees. Trust your gut—if something feels off, walk away.

Suggestions for you

Read MoreLet’s work together

Every week we showcase three charitable organizations that our donations are sent to. Our clients are able to choose which of these three will receive their gift when they add coverage to their vehicle...

Short Bed vs. Long Bed Trucks: The Ultimate Comparison Guide for 2025

Short Bed vs. Long Bed Trucks: The Ultimate Comparison Guide for 2025 How to Pump Gas: A Complete Step-by-Step Guide for Every Driver

How to Pump Gas: A Complete Step-by-Step Guide for Every Driver The Ultimate Hummer H2 Buyer’s Guide: Common Problems, Reliability, and What to Know Before You Buy

The Ultimate Hummer H2 Buyer’s Guide: Common Problems, Reliability, and What to Know Before You Buy The #1 Reason the 2015 Toyota Corolla Still Dominates Used Car Sales (And Why You Need One)

The #1 Reason the 2015 Toyota Corolla Still Dominates Used Car Sales (And Why You Need One) Stop The Steal: Your Ultimate Guide to Catalytic Converter Theft Prevention

Stop The Steal: Your Ultimate Guide to Catalytic Converter Theft Prevention Water Damage & Your Home Warranty: Understanding What's Truly Covered (and What Isn't!)

Water Damage & Your Home Warranty: Understanding What's Truly Covered (and What Isn't!) Confessions of a Car Salesperson: What They Don’t Want You to Know (And How to Use It to Your Advantage)

Confessions of a Car Salesperson: What They Don’t Want You to Know (And How to Use It to Your Advantage) The Ultimate Guide to the 2025 Jaguar F-Pace: Performance, Luxury & Value

The Ultimate Guide to the 2025 Jaguar F-Pace: Performance, Luxury & Value CAN Bus Explained: How Your Car's Digital Network Connects Everything (and Why It Matters)

CAN Bus Explained: How Your Car's Digital Network Connects Everything (and Why It Matters) The Basics of Car Insurance Deductibles and How They Work

The Basics of Car Insurance Deductibles and How They Work Navigating Bank of America Auto Loans: What You Need to Know

Navigating Bank of America Auto Loans: What You Need to Know 5 Steps to a Higher Credit Score: Your Guide to Better Auto Loan Rates

5 Steps to a Higher Credit Score: Your Guide to Better Auto Loan Rates The General Auto Insurance: What You Need to Know

The General Auto Insurance: What You Need to Know Is the Cadillac ATS Worth It? A Review of Costs and Value

Is the Cadillac ATS Worth It? A Review of Costs and Value Capital One Auto Loans: Your Complete Guide to Financing Your Next Vehicle

Capital One Auto Loans: Your Complete Guide to Financing Your Next Vehicle The Ultimate Guide to Selling Your Car

The Ultimate Guide to Selling Your Car Nationwide Auto Insurance: 10 Essential Things to Know Before You Buy

Nationwide Auto Insurance: 10 Essential Things to Know Before You Buy Lost Keys? Noble Quote Has You Covered (and More!)

Lost Keys? Noble Quote Has You Covered (and More!) The Digital Garage for Your Dollars: Navigating the World of Trading Apps

The Digital Garage for Your Dollars: Navigating the World of Trading Apps The True Cost of Owning a G80 BMW M3: Beyond the Sticker Price

The True Cost of Owning a G80 BMW M3: Beyond the Sticker Price O'Reilly Auto Parts: Your Comprehensive Guide to Services, Products, and More

O'Reilly Auto Parts: Your Comprehensive Guide to Services, Products, and More Land Cruiser 2025: Unleashed & Uncosted!

Land Cruiser 2025: Unleashed & Uncosted! Noble Quote vs. Amber: Which Automotive Service Offers the Best Value?

Noble Quote vs. Amber: Which Automotive Service Offers the Best Value? Unlock Lower Rates: Your Guide to Travelers Auto Insurance Discounts

Unlock Lower Rates: Your Guide to Travelers Auto Insurance Discounts Porsche Macan: The REAL Cost of Ownership (2015–2024 Review)

Porsche Macan: The REAL Cost of Ownership (2015–2024 Review) Land Rover Evoque Review (2012–2024): True Cost of Ownership Revealed

Land Rover Evoque Review (2012–2024): True Cost of Ownership Revealed Your Car as an NFT? The Future of Automotive Ownership on Ethereum

Your Car as an NFT? The Future of Automotive Ownership on Ethereum Unlock Cheaper Rates: Your Ultimate Guide to State Farm Auto Insurance Discounts

Unlock Cheaper Rates: Your Ultimate Guide to State Farm Auto Insurance Discounts Online Used Car Shopping: What You NEED to Know Before You Buy

Online Used Car Shopping: What You NEED to Know Before You Buy The 7 Hidden Costs of Skipping Your Extended Car Warranty

The 7 Hidden Costs of Skipping Your Extended Car Warranty Can You Afford the 6th Gen Camaro? A True Cost Breakdown

Can You Afford the 6th Gen Camaro? A True Cost Breakdown AutoZone: Your DIY Partner or a Pro's Pit Stop? A Comprehensive Review

AutoZone: Your DIY Partner or a Pro's Pit Stop? A Comprehensive Review Reborn Rugged: Why the Ineos Grenadier is More Than Just an SUV

Reborn Rugged: Why the Ineos Grenadier is More Than Just an SUV Factors Affecting Your Car Insurance Rates: The Ultimate Guide to Understanding Costs

Factors Affecting Your Car Insurance Rates: The Ultimate Guide to Understanding Costs How to Maximize Your Car Trade-In Value: The Ultimate Guide

How to Maximize Your Car Trade-In Value: The Ultimate Guide The Importance of Wheel Alignment and Balancing: Smooth Driving and Tire Longevity

The Importance of Wheel Alignment and Balancing: Smooth Driving and Tire Longevity BYD Cars 2025: Your Ultimate Guide to the Full Lineup & Latest Innovations

BYD Cars 2025: Your Ultimate Guide to the Full Lineup & Latest Innovations Don't Miss Out: How to Buy Crypto Before the Next FOMO Wave (2025 Guide)

Don't Miss Out: How to Buy Crypto Before the Next FOMO Wave (2025 Guide) Farmers Auto Insurance: Your Ultimate 2025 Guide to Coverage, Rates & Savings

Farmers Auto Insurance: Your Ultimate 2025 Guide to Coverage, Rates & Savings Brake Pads: The Science of Stopping (How They're Made, What They Do, & Signs of Wear)

Brake Pads: The Science of Stopping (How They're Made, What They Do, & Signs of Wear) Spark Plugs: The Tiny Titans That Ignite Your Engine

Spark Plugs: The Tiny Titans That Ignite Your Engine The Ultimate Showdown: Car Broker vs. DIY Car Buying – Which Path Saves You More?

The Ultimate Showdown: Car Broker vs. DIY Car Buying – Which Path Saves You More? Kelley Blue Book Instant Cash Offer: Your Ultimate Guide to Getting Top Dollar for Your Car

Kelley Blue Book Instant Cash Offer: Your Ultimate Guide to Getting Top Dollar for Your Car Oxygen Sensors: The 'Eyes' of Your Engine (Their Role, What Goes Wrong, & Why They Matter)

Oxygen Sensors: The 'Eyes' of Your Engine (Their Role, What Goes Wrong, & Why They Matter) Carvana vs. Traditional Dealerships: The Ultimate Showdown for Your Next Car Purchase

Carvana vs. Traditional Dealerships: The Ultimate Showdown for Your Next Car Purchase Full Tort vs. Limited Tort Auto Insurance: The Ultimate Guide to Protecting Your Rights & Payout

Full Tort vs. Limited Tort Auto Insurance: The Ultimate Guide to Protecting Your Rights & Payout CV Axles: Putting Power to the Wheels (What They Do, Signs of Wear, & When to Replace)

CV Axles: Putting Power to the Wheels (What They Do, Signs of Wear, & When to Replace) 10 Essential Car Prep Tips for Your Family’s Epic Summer Road Trips (2025 Edition)

10 Essential Car Prep Tips for Your Family’s Epic Summer Road Trips (2025 Edition) DriveTime Review 2024/2025: Your Complete A–Z Guide to Buying a Car There

DriveTime Review 2024/2025: Your Complete A–Z Guide to Buying a Car There Rideshare Riches: How Much Can YOU Really Earn Driving for Uber & Lyft in 2025?

Rideshare Riches: How Much Can YOU Really Earn Driving for Uber & Lyft in 2025? The Car Computer (ECM/ECU): The Brain of Your Vehicle (Its Functions, Troubleshooting, & Updates)

The Car Computer (ECM/ECU): The Brain of Your Vehicle (Its Functions, Troubleshooting, & Updates) The Ultimate Truck/SUV Beach Driving Guide: Prep, Safety, & Post-Sand Care

The Ultimate Truck/SUV Beach Driving Guide: Prep, Safety, & Post-Sand Care The Mass Airflow Sensor (MAF): Engine's Air Traffic Controller (Function, Symptoms of Failure, & Cleaning)

The Mass Airflow Sensor (MAF): Engine's Air Traffic Controller (Function, Symptoms of Failure, & Cleaning) The Reigning Champion: Why the 2025 Ford Ranger is North America's Truck of the Year

The Reigning Champion: Why the 2025 Ford Ranger is North America's Truck of the Year Car Coolant Flush: The Ultimate Guide to a Healthy Engine & Extended Vehicle Life

Car Coolant Flush: The Ultimate Guide to a Healthy Engine & Extended Vehicle Life Serpentine Belt: Powering Your Car's Accessories (Its Job, Signs of Wear, & Replacement)

Serpentine Belt: Powering Your Car's Accessories (Its Job, Signs of Wear, & Replacement) BMW M2: The Pure Driving Machine Reborn?

BMW M2: The Pure Driving Machine Reborn? The Ultimate Protection Plan: How Life Insurance Drives Your Family’s Future

The Ultimate Protection Plan: How Life Insurance Drives Your Family’s Future Power Steering System: Effortless Control (How It Works, Common Issues, & Maintenance Tips)

Power Steering System: Effortless Control (How It Works, Common Issues, & Maintenance Tips) End-of-Month Car Deals: Myth or Money-Saver?

End-of-Month Car Deals: Myth or Money-Saver? NobleQuote.com Presents: American National Auto Insurance – Your Complete Guide

NobleQuote.com Presents: American National Auto Insurance – Your Complete Guide Edmunds.com: Your Ultimate Guide to Smarter Car Buying

Edmunds.com: Your Ultimate Guide to Smarter Car Buying The Definitive Guide to Frank Martin's Cars in The Transporter Series

The Definitive Guide to Frank Martin's Cars in The Transporter Series Pre-Existing Conditions and Home Warranties: What You Need to Know Before You Buy

Pre-Existing Conditions and Home Warranties: What You Need to Know Before You Buy Why Your Car Insurance is Skyrocketing in 2025 (and How NobleQuote Can Help)

Why Your Car Insurance is Skyrocketing in 2025 (and How NobleQuote Can Help) The 2025 Toyota Supra: The Grand Finale of a Legend?

The 2025 Toyota Supra: The Grand Finale of a Legend? Teen Driver Car Insurance Costs & Strategies: How to Get Affordable Coverage for Young Drivers

Teen Driver Car Insurance Costs & Strategies: How to Get Affordable Coverage for Young Drivers Clutch: Manual Transmission’s Master Link (How It Transfers Power, Signs of Wear, & Replacement)

Clutch: Manual Transmission’s Master Link (How It Transfers Power, Signs of Wear, & Replacement) Esurance Auto Insurance Review 2025: Is It the Right Digital Fit for Your Ride?

Esurance Auto Insurance Review 2025: Is It the Right Digital Fit for Your Ride? Is Your Car Insurance Enough? Unexpected Repairs and the Peace of Mind of a NobleQuote Vehicle Service Contract

Is Your Car Insurance Enough? Unexpected Repairs and the Peace of Mind of a NobleQuote Vehicle Service Contract Cabin Air Filter: Breathing Easy in Your Car (What It Does, Why It Matters, & When to Replace)

Cabin Air Filter: Breathing Easy in Your Car (What It Does, Why It Matters, & When to Replace) Don't Let a Blown Engine Derail Your Life: The Auto Pro's Guide to Disability Insurance

Don't Let a Blown Engine Derail Your Life: The Auto Pro's Guide to Disability Insurance Godzilla’s Reign: Unpacking the Legend of the 5th Gen Nissan GT-R

Godzilla’s Reign: Unpacking the Legend of the 5th Gen Nissan GT-R Car Fuses: The Unsung Heroes of Your Electrical System (What They Do, Common Failures, & How to Replace)

Car Fuses: The Unsung Heroes of Your Electrical System (What They Do, Common Failures, & How to Replace) Protect Your Ride & Your Family: Why Northwestern Mutual Life Insurance Matters for Car Owners

Protect Your Ride & Your Family: Why Northwestern Mutual Life Insurance Matters for Car Owners Unlock 200,000 Miles: The Ultimate Preventative Car Maintenance Schedule & Checklist

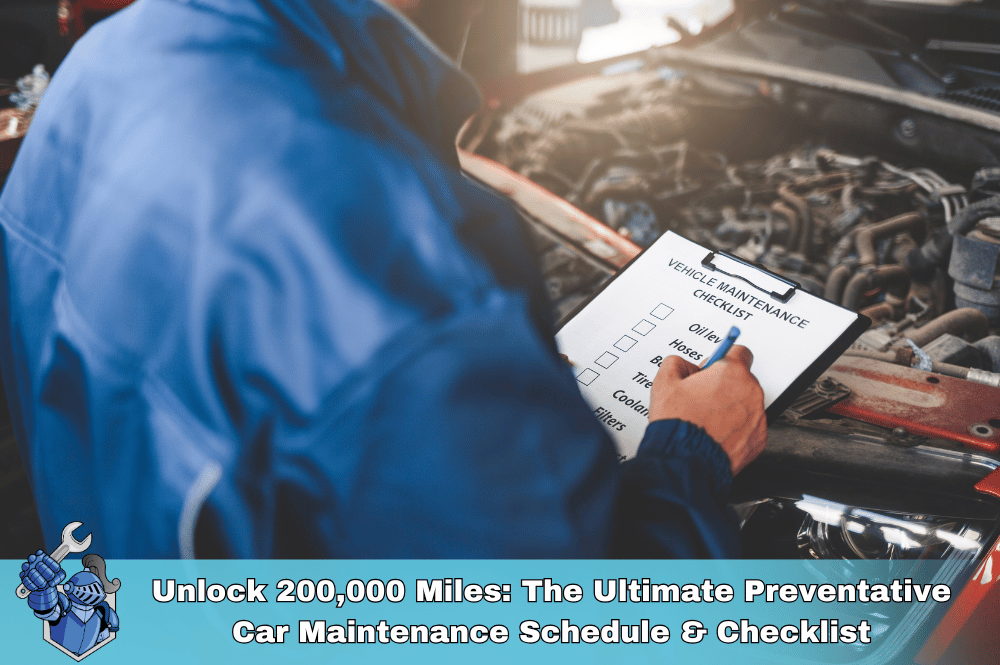

Unlock 200,000 Miles: The Ultimate Preventative Car Maintenance Schedule & Checklist Scout Motors: The American Icon Reborn for the Electric Age

Scout Motors: The American Icon Reborn for the Electric Age How to Replace Wiper Blades: A Step-by-Step DIY Guide (Save Money & See Clearly!)

How to Replace Wiper Blades: A Step-by-Step DIY Guide (Save Money & See Clearly!) The Ultimate Guide to Cheap Car Insurance: Find Your Lowest Rates in 2025

The Ultimate Guide to Cheap Car Insurance: Find Your Lowest Rates in 2025 The 2025 Automotive Retirement Number: What Auto Pros Need to Save for a Comfortable Ride

The 2025 Automotive Retirement Number: What Auto Pros Need to Save for a Comfortable Ride Pre-Purchase Inspection (PPI): Your Essential Checklist Before Buying Any Used Car

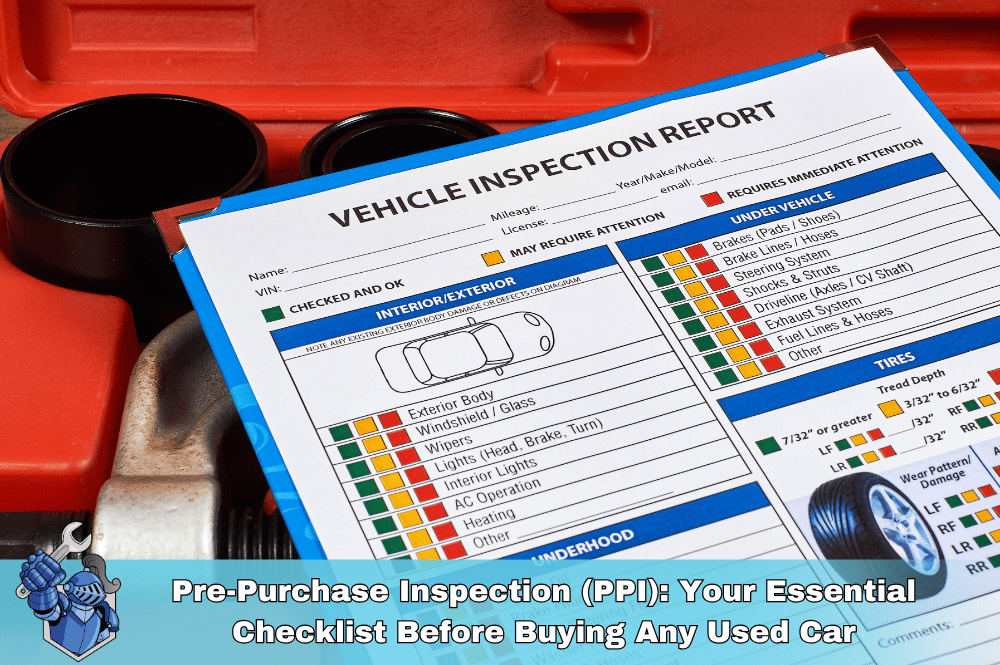

Pre-Purchase Inspection (PPI): Your Essential Checklist Before Buying Any Used Car Unearthing Automotive Gold: The Underrated Used Cars You Need to Buy Now

Unearthing Automotive Gold: The Underrated Used Cars You Need to Buy Now The Last Ride: Why the 2025 Audi A4 is the Ultimate Collectible (and Daily Driver)

The Last Ride: Why the 2025 Audi A4 is the Ultimate Collectible (and Daily Driver) 2025 Corvette ZR1: The Ultimate Guide to Specs, Price, and Performance

2025 Corvette ZR1: The Ultimate Guide to Specs, Price, and Performance Does Driving for Uber/Lyft/DoorDash Void Your Car’s Warranty? & How to Get Covered

Does Driving for Uber/Lyft/DoorDash Void Your Car’s Warranty? & How to Get Covered Headlight Restoration & Bulb Replacement: The Ultimate Guide to Perfect Car Lighting

Headlight Restoration & Bulb Replacement: The Ultimate Guide to Perfect Car Lighting The Ultimate Guide to Motorcycle Extended Warranties: Is It Worth It for Your Ride?

The Ultimate Guide to Motorcycle Extended Warranties: Is It Worth It for Your Ride? 2025 BMW X7 vs. Mercedes-Benz GLS: Which Luxury SUV Reigns Supreme?

2025 BMW X7 vs. Mercedes-Benz GLS: Which Luxury SUV Reigns Supreme? Barbie's Dream Car: The Ultimate EV Conversion? (And Why Even Fantasy Needs a Real Warranty)

Barbie's Dream Car: The Ultimate EV Conversion? (And Why Even Fantasy Needs a Real Warranty) Blown Head Gasket: The $2,500+ Repair Nightmare That Catches Car Owners Off Guard – Learn How to Prepare

Blown Head Gasket: The $2,500+ Repair Nightmare That Catches Car Owners Off Guard – Learn How to Prepare 2025 Cadillac Lyriq Review: The Ultimate Luxury Electric SUV?

2025 Cadillac Lyriq Review: The Ultimate Luxury Electric SUV? Pep Boys: Your Complete Guide to Auto Parts, Service & Repair (2025 Edition)

Pep Boys: Your Complete Guide to Auto Parts, Service & Repair (2025 Edition) Drive Smarter: Unlock Vehicle Protection with 0% APR Service Contract Payments

Drive Smarter: Unlock Vehicle Protection with 0% APR Service Contract Payments 2025 Harley-Davidson Sportster S: The Ultimate Review & Buyer’s Guide

2025 Harley-Davidson Sportster S: The Ultimate Review & Buyer’s Guide New Jersey Car Insurance Laws 2025–2026: Your Essential Guide to What’s Changed & What’s Next

New Jersey Car Insurance Laws 2025–2026: Your Essential Guide to What’s Changed & What’s Next The Ultimate Dodge Viper Guide: All Generations, Specs, & History (1991–2017)

The Ultimate Dodge Viper Guide: All Generations, Specs, & History (1991–2017) Meineke Oil Change: Everything You Need to Know (Prices, Packages, and Why It Matters)

Meineke Oil Change: Everything You Need to Know (Prices, Packages, and Why It Matters) 2025 Porsche Taycan: The Ultimate Guide to Porsche's Electrifying Evolution

2025 Porsche Taycan: The Ultimate Guide to Porsche's Electrifying Evolution The Connected Car’s 'Black Box': How Your Data Impacts Warranty Claims

The Connected Car’s 'Black Box': How Your Data Impacts Warranty Claims Automatic vs. Hand Wash: Which is Truly Safer for Your Car's Finish?

Automatic vs. Hand Wash: Which is Truly Safer for Your Car's Finish? The Ultimate Toyota RAV4 Guide: Every Generation Explored (1994–Present)

The Ultimate Toyota RAV4 Guide: Every Generation Explored (1994–Present) Homeowners Insurance vs. Home Warranty: A Clear Breakdown for Every Homeowner

Homeowners Insurance vs. Home Warranty: A Clear Breakdown for Every Homeowner Erie Auto Insurance Review 2025: Rates, Discounts, & Why Drivers Choose It

Erie Auto Insurance Review 2025: Rates, Discounts, & Why Drivers Choose It The Ultimate Bentley Bentayga Buyer’s Guide: Every Model, Trim & Real-World Ownership Costs

The Ultimate Bentley Bentayga Buyer’s Guide: Every Model, Trim & Real-World Ownership Costs The Ultimate Lamborghini Urus Buyer's Guide: Every Generation, Model, & What You Need to Know Before Owning

The Ultimate Lamborghini Urus Buyer's Guide: Every Generation, Model, & What You Need to Know Before Owning Mazda6 Generations Explained: A Complete History & Buyer's Guide (All Models)

Mazda6 Generations Explained: A Complete History & Buyer's Guide (All Models) The True Cost of Luxury Car Repair: Are You Paying Too Much Without a Vehicle Service Contract?

The True Cost of Luxury Car Repair: Are You Paying Too Much Without a Vehicle Service Contract? Chubb Auto Insurance: The Premier Choice for Luxury, Exotic, and Classic Cars

Chubb Auto Insurance: The Premier Choice for Luxury, Exotic, and Classic Cars Don't Get Ripped Off: Your Complete Guide to Smart Car Repairs

Don't Get Ripped Off: Your Complete Guide to Smart Car Repairs Full Tort vs. Limited Tort in Pennsylvania: Which is Right for You? (A Driver's Definitive Guide)

Full Tort vs. Limited Tort in Pennsylvania: Which is Right for You? (A Driver's Definitive Guide) Cash vs. Car Loan: Which is Right for Your Next Vehicle Purchase?

Cash vs. Car Loan: Which is Right for Your Next Vehicle Purchase? The New Land Rover Defender: Redefining Rugged Luxury (Your Ultimate Review & Buying Guide)

The New Land Rover Defender: Redefining Rugged Luxury (Your Ultimate Review & Buying Guide) The Silent Killer: Why Not Driving Your Car Wears It Out Faster Than You Think

The Silent Killer: Why Not Driving Your Car Wears It Out Faster Than You Think Beyond the Basics: Unpacking AIG's Elite Auto Insurance for High-Net-Worth Drivers

Beyond the Basics: Unpacking AIG's Elite Auto Insurance for High-Net-Worth Drivers The Ultimate 2025 Hyundai Santa Fe Review: Your Complete Buyer’s Guide

The Ultimate 2025 Hyundai Santa Fe Review: Your Complete Buyer’s Guide The Repair Shop Rejection Reflex: Why Customers Say No to Essential Car Fixes

The Repair Shop Rejection Reflex: Why Customers Say No to Essential Car Fixes Rolls-Royce Cullinan Review: Is This the World's Ultimate Luxury SUV?

Rolls-Royce Cullinan Review: Is This the World's Ultimate Luxury SUV? Amica Auto Insurance Review 2025: Unpacking Value, Dividends, and Why It Consistently Ranks #1 for Service

Amica Auto Insurance Review 2025: Unpacking Value, Dividends, and Why It Consistently Ranks #1 for Service Get Your Price Instantly: The Smart Way to Buy & Manage Your Car's Extended Warranty Online with NobleQuote

Get Your Price Instantly: The Smart Way to Buy & Manage Your Car's Extended Warranty Online with NobleQuote The Ultimate 2025 Nissan Armada Buyer's Guide: Everything You Need to Know

The Ultimate 2025 Nissan Armada Buyer's Guide: Everything You Need to Know Rideshare Safety Unlocked: The Ultimate Guide to Secure Uber & Lyft Rides

Rideshare Safety Unlocked: The Ultimate Guide to Secure Uber & Lyft Rides The End of an Era: Why the Nissan Titan Was Discontinued (And What It Means for Truck Buyers)

The End of an Era: Why the Nissan Titan Was Discontinued (And What It Means for Truck Buyers) The Ultimate Guide to Home Warranty Plumbing Coverage: What's Covered, What's Not, and Why It Matters

The Ultimate Guide to Home Warranty Plumbing Coverage: What's Covered, What's Not, and Why It Matters Drive: The Ryan Gosling Movie That Defined a Generation of Car Culture

Drive: The Ryan Gosling Movie That Defined a Generation of Car Culture