The best strategy combines dollar-cost averaging, diversified crypto holdings, and secure offline storage. Long-term investors typically hold top assets like Bitcoin and Ethereum, stake tokens for passive income, and avoid short-term emotional trading.

Cryptocurrency is no longer just a fringe technology or speculative asset. Over the past decade, it has evolved into a serious contender for long-term investment and wealth generation. From Bitcoin’s meteoric rise to Ethereum’s smart contract revolution, crypto is reshaping how we think about money, investing, and the future of finance. If you’ve ever asked yourself how to build wealth with cryptocurrency—or even how to plan for generational wealth using long-term crypto investments—you’re not alone.

In this guide, we’ll explore proven long-term crypto investment strategies, explain why cryptocurrency is an emerging tool for building sustainable wealth, and help you construct a roadmap that can last not just years, but generations.

Why Long-Term Crypto Investing is Gaining Momentum

Traditional financial vehicles like stocks, bonds, and real estate have long been the go-to avenues for wealth creation. But times are changing. The decentralized, permissionless, and borderless nature of blockchain technology has created a financial ecosystem with massive upside potential. According to CoinMarketCap, the global crypto market cap has surged past $2 trillion as of early 2025, with institutional interest at an all-time high.

So why the shift? Because crypto offers:

- High potential returns over time

- A hedge against inflation and fiat currency devaluation

- Access to new financial tools like staking, yield farming, and decentralized finance (DeFi)

- Opportunities for generational wealth transfer using secure and decentralized wallets

The keyword here is long-term. Those looking for quick flips may be gambling, not investing. The crypto long game is about strategy, patience, and understanding how this technology evolves.

Step 1: Build a Long-Term Crypto Investment Strategy

1. Set Clear Goals

Do you want to retire early? Create a family trust? Pass assets to your children? Long-term goals determine how much risk you're willing to take and which assets you choose to hold. Long-term crypto investment is not one-size-fits-all.

2. Use Dollar Cost Averaging (DCA)

Instead of lump-sum investing, consider dollar cost averaging—buying small, fixed amounts at regular intervals. This reduces the impact of market volatility and allows you to slowly build positions in assets like Bitcoin, Ethereum, or undervalued altcoins for long-term wealth accumulation.

Learn more about the power of compounding in crypto investing through recurring buys and staking rewards.

3. Diversify Your Portfolio

Avoid putting all your eggs in one blockchain. Consider holding a mix of:

- Bitcoin (digital gold)

- Ethereum (smart contract platform)

- Layer 2 solutions (e.g., Polygon, Arbitrum)

- DeFi tokens (e.g., Aave, Uniswap)

- Yield-generating assets (e.g., Lido for ETH staking)

Diversifying your crypto portfolio for long-term growth can protect against downturns and capitalize on sector-specific booms.

4. Understand Market Cycles

Crypto follows distinct boom-bust cycles. Learning to analyze these market cycles helps investors avoid panic selling or FOMO buying. Use fundamental analysis to evaluate a project’s real utility, network activity, developer engagement, and long-term use case viability.

Step 2: Explore Passive Income & Staking

While long-term holders (HODLers) tend to let their investments sit untouched, you can grow your holdings through passive strategies:

- Staking: Lock tokens in a network to earn rewards

- Yield Farming: Provide liquidity in DeFi pools to earn interest

- Node Running: For technically skilled users, running a validator node on certain chains can generate ongoing income

These approaches align with the concept of sustainable crypto wealth building and compounding growth over time.

For example, staking Ethereum currently yields 3-5% annually, and this reward compounds year-over-year when reinvested.

Step 3: Manage Risk for Generational Wealth

1. Security First

Use cold wallets or hardware wallets like Ledger or Trezor for long-term storage. Avoid storing large amounts on exchanges. If your goal is to secure crypto for generational wealth transfer, custody matters more than ever.

2. Plan for Inheritance

Create a digital asset will or use services like Casa or Unchained Capital’s multi-signature vaults to ensure your heirs can access your funds.

3. Tax-Efficient Strategies

Utilize long-term capital gains tax rates by holding for at least 12 months. Explore crypto retirement accounts (like a Bitcoin IRA) for potential tax deferral.

Understanding tax-efficient long-term crypto investing strategies can save thousands or more over decades.

The Psychology of Long-Term Crypto Investing

Success in crypto isn’t just technical, it’s emotional. Long-term investors must:

- Avoid emotional trading during bear markets

- Stay committed to a well-defined strategy

- Rebalance periodically to maintain desired allocation

- Celebrate slow, steady growth over time

Remember, the goal isn’t to get rich quick, but to build enduring wealth. Patience pays.

Crypto vs Traditional Investments

| Factor | Traditional Assets | Long-Term Crypto |

|---|---|---|

| Average Annual Return | 7-10% (S&P 500) | 20-30% (BTC/ETH historical) |

| Liquidity | High | High |

| Volatility | Low to Moderate | High |

| Innovation Exposure | Low | Very High |

| Accessibility | Often requires broker | Open to anyone |

| Inflation Hedge | Moderate | Strong (esp. BTC) |

Planning Crypto Investments for Retirement

Yes, you can use crypto to plan for retirement. Options include:

- Bitcoin IRAs or self-directed IRAs with crypto holdings

- Long-term holdings in cold wallets

- Automatic DCA with retirement in mind

- Passive income via staking to supplement other income streams

Long-term crypto investment for retirement planning is growing in popularity, especially among Gen Z and Millennials.

Resources to Start Building Generational Wealth

Conclusion: Think in Decades, Not Days

When it comes to cryptocurrency, the real winners aren’t the ones chasing quick pumps. They’re the people who educate themselves, develop smart long-term strategies, and stay consistent. Whether you’re a first-time investor or someone looking to build generational wealth through crypto, the key is to think long-term.

Start with a strategy, secure your assets, stay emotionally grounded, and watch your crypto portfolio grow not just for your future, but for your children too.

👉 Explore more financial protection insights at the Noble Quote Learning Center

FAQ: How to Build Long-Term Wealth with Cryptocurrency (Backed by Strategy, Not Hype)

What is the best strategy for building long-term wealth with cryptocurrency?

Can cryptocurrency really help build generational wealth?

Yes, when managed correctly. Crypto offers unique advantages like decentralization, high upside potential, and global accessibility. Families can use hardware wallets, smart contracts, and multi-signature tools to pass down assets securely.

How do I choose the best cryptocurrencies for long-term investing?

Look for coins with strong fundamentals, long-term use cases, and active development communities. Bitcoin and Ethereum remain top choices, while emerging altcoins in DeFi, AI, and infrastructure may offer future growth.

What are the safest ways to store crypto for years or decades?

Use cold wallets like Ledger or Trezor for offline storage. Set up redundancy with secure backups and consider multi-signature wallets. Avoid keeping large sums on exchanges due to hacking risk.

Should I stake my crypto for long-term gains?

Yes, staking can generate passive income and compound wealth. Platforms like Ethereum, Cardano, and Polkadot offer rewards to long-term holders who help secure their networks.

How does dollar-cost averaging help with long-term crypto investing?

Dollar-cost averaging reduces the impact of short-term volatility by spreading purchases over time. It’s a simple, disciplined approach that aligns well with long-term wealth accumulation.

Is crypto too volatile for retirement or wealth transfer planning?

Crypto is volatile short-term, but history shows resilience and upward trends in leading assets. With proper risk management and secure planning, crypto can complement a retirement or estate strategy.

What role does blockchain play in long-term wealth creation?

Blockchain is revolutionizing finance, real estate, and digital ownership. Investing in its infrastructure early could be similar to buying internet companies in the early 2000s.

How can I pass my crypto to my children or heirs?

Create a digital asset plan, include detailed access instructions, and consider tools like inheritance platforms or multi-sig wallets. Legal advisors now specialize in crypto estate planning.

Suggestions for you

Read MoreLet’s work together

Every week we showcase three charitable organizations that our donations are sent to. Our clients are able to choose which of these three will receive their gift when they add coverage to their vehicle...

Living with a Legend: The Hidden Costs of Dodge Challenger Hellcat Ownership

Living with a Legend: The Hidden Costs of Dodge Challenger Hellcat Ownership Beyond Self-Driving: OpenAI and the Next Generation of Automotive Intelligence

Beyond Self-Driving: OpenAI and the Next Generation of Automotive Intelligence Blockchain Basics: The Technology Behind Cryptocurrencies

Blockchain Basics: The Technology Behind Cryptocurrencies New vs. Used: A Financial Showdown for Your Next Vehicle

New vs. Used: A Financial Showdown for Your Next Vehicle Depreciation Demystified: Planning for Your Car’s Future Value

Depreciation Demystified: Planning for Your Car’s Future Value Smart Buyer’s Guide: Ford F-250 Review and Long-Term Ownership Costs (2022–2024)

Smart Buyer’s Guide: Ford F-250 Review and Long-Term Ownership Costs (2022–2024) DIY Danger? The Financial Risks of Handling Car Repairs Yourself

DIY Danger? The Financial Risks of Handling Car Repairs Yourself The Downtime Trap: How Car Repairs Can Cost You More Than Just the Bill

The Downtime Trap: How Car Repairs Can Cost You More Than Just the Bill Tech Troubles Ahead? The Rising Costs of Modern Vehicle Repairs

Tech Troubles Ahead? The Rising Costs of Modern Vehicle Repairs Drive Smart, Save Smarter: Your Guide to Budgeting for Car Care

Drive Smart, Save Smarter: Your Guide to Budgeting for Car Care Don’t Let Tariffs Hike Your Bills: The Smart Way an Extended Warranty Saves You on Car Repairs

Don’t Let Tariffs Hike Your Bills: The Smart Way an Extended Warranty Saves You on Car Repairs Chevy Colorado: Unpacking the Features and the Real Cost of Ownership

Chevy Colorado: Unpacking the Features and the Real Cost of Ownership Safe Kids: Your Comprehensive Guide to Child Car Seat Installation Tips and Guidelines

Safe Kids: Your Comprehensive Guide to Child Car Seat Installation Tips and Guidelines Unlock Better Opportunities: Your Guide to Understanding and Improving Your Credit Score

Unlock Better Opportunities: Your Guide to Understanding and Improving Your Credit Score Beyond the Hype: A Realistic Look at Hyundai Ioniq 5 Ownership Costs and Performance

Beyond the Hype: A Realistic Look at Hyundai Ioniq 5 Ownership Costs and Performance Bitcoin vs. Cash: A Head-to-Head Comparison of Features

Bitcoin vs. Cash: A Head-to-Head Comparison of Features Decoding Your Wallet: The Benefits of Using Cash and Credit Wisely

Decoding Your Wallet: The Benefits of Using Cash and Credit Wisely Kia Telluride Review: Unpacking the Features and the Real Cost to Own

Kia Telluride Review: Unpacking the Features and the Real Cost to Own NobleQuote: Best Auto Protection, Not Just the Oldest

NobleQuote: Best Auto Protection, Not Just the Oldest What is a Home Warranty and Do You Need One?

What is a Home Warranty and Do You Need One? Recession-Proof Your Ride: Why an Extended Car Warranty Makes Sense Now

Recession-Proof Your Ride: Why an Extended Car Warranty Makes Sense Now RV Road Trip Ready: Secure Your Adventures with Extended Warranty Coverage

RV Road Trip Ready: Secure Your Adventures with Extended Warranty Coverage Stop Paying for Potholes: The Smart Way to Protect Your Wheels and Tires

Stop Paying for Potholes: The Smart Way to Protect Your Wheels and Tires Don’t Get Stuck With Repair Bills: Ford Edge Warranty Coverage Explained

Don’t Get Stuck With Repair Bills: Ford Edge Warranty Coverage Explained Navigating the Online Vehicle Marketplace: Your Comprehensive Guide to Finding the Perfect Car or Truck

Navigating the Online Vehicle Marketplace: Your Comprehensive Guide to Finding the Perfect Car or Truck Maximize Your Savings: Understanding Your Vehicle Service Contract Deductible Options

Maximize Your Savings: Understanding Your Vehicle Service Contract Deductible Options Vehicle Service Contracts for SUVs and Trucks: Protecting Your Investment

Vehicle Service Contracts for SUVs and Trucks: Protecting Your Investment What to Do If Your Vehicle Service Contract Claim Is Denied

What to Do If Your Vehicle Service Contract Claim Is Denied What Happens to My Vehicle Service Contract If I Sell My Car?

What Happens to My Vehicle Service Contract If I Sell My Car? Extended Car Warranty with Active Factory Coverage: Smart Move or Waste of Money?

Extended Car Warranty with Active Factory Coverage: Smart Move or Waste of Money? Nissan Pathfinder Common Problems: A Complete Repair Guide

Nissan Pathfinder Common Problems: A Complete Repair Guide Keeping vs. Selling: Weighing Your Car Options & the Value of an Extended Car Warranty

Keeping vs. Selling: Weighing Your Car Options & the Value of an Extended Car Warranty DIY Oil Change: Do It Better Than the Pros (and Save Money!)

DIY Oil Change: Do It Better Than the Pros (and Save Money!) Beyond Coverage: How Extended Warranties Can Expedite Your Car Repairs Amid Supply Chain Challenges

Beyond Coverage: How Extended Warranties Can Expedite Your Car Repairs Amid Supply Chain Challenges Protecting Your Ride Like Jalen Protects the Pocket: Cars, Eagles, and Smart Investments

Protecting Your Ride Like Jalen Protects the Pocket: Cars, Eagles, and Smart Investments Rivian R1S Review: Is This the Ultimate Electric Adventure SUV? (2025)

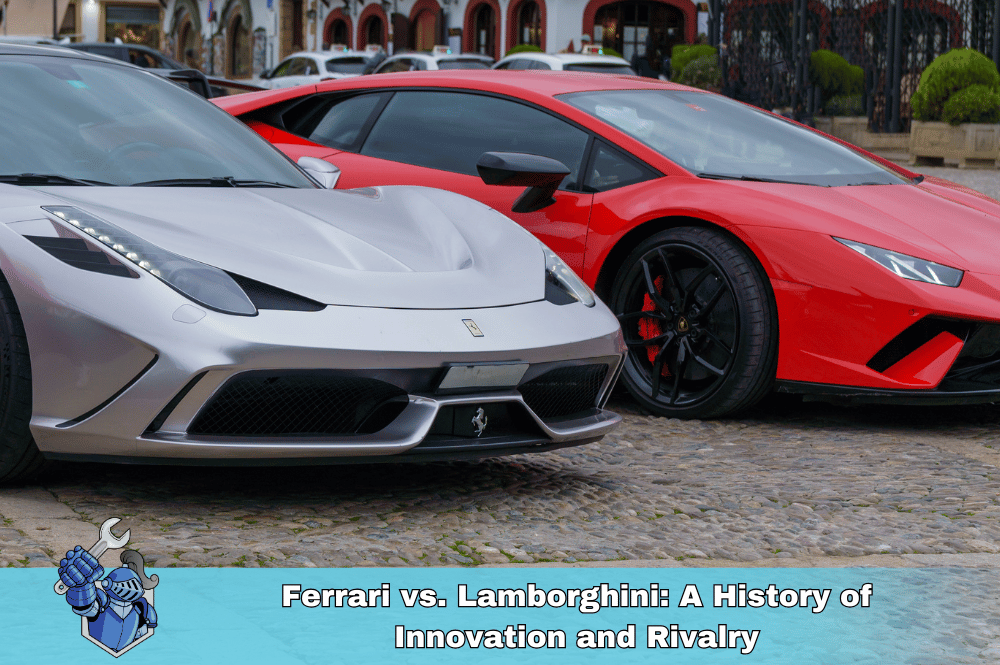

Rivian R1S Review: Is This the Ultimate Electric Adventure SUV? (2025) Ferrari vs. Lamborghini: A History of Innovation and Rivalry

Ferrari vs. Lamborghini: A History of Innovation and Rivalry The Truck Owner’s Peace of Mind: Why Noble Quote Leads the Pack in Truck Repair Protection

The Truck Owner’s Peace of Mind: Why Noble Quote Leads the Pack in Truck Repair Protection Noble Quote: Driving with Confidence, Protected from Unexpected Repairs

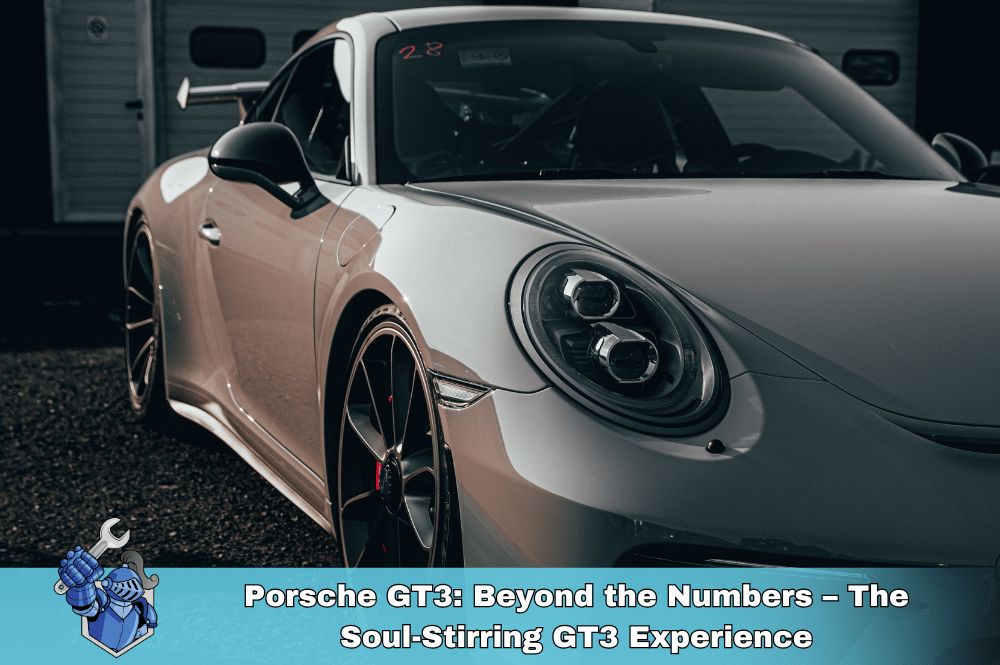

Noble Quote: Driving with Confidence, Protected from Unexpected Repairs Porsche GT3: Beyond the Numbers – The Soul-Stirring GT3 Experience

Porsche GT3: Beyond the Numbers – The Soul-Stirring GT3 Experience Kansas City Chiefs Players: You Won’t Believe What They’re Driving!

Kansas City Chiefs Players: You Won’t Believe What They’re Driving! Dodge TRX: King of the Off-Road

Dodge TRX: King of the Off-Road Ford Raptor Extended Warranty Guide: Conquer the Road with Confidence

Ford Raptor Extended Warranty Guide: Conquer the Road with Confidence Subaru Extended Warranty: Your Ultimate Guide

Subaru Extended Warranty: Your Ultimate Guide Protect Your Car & the Planet: Introducing NobleQuote's Green Choice Program

Protect Your Car & the Planet: Introducing NobleQuote's Green Choice Program Chevy Malibu Ownership: Staying Ahead of the Repair Curve

Chevy Malibu Ownership: Staying Ahead of the Repair Curve The Most Common Car Breakdowns of 2025 (And How to Avoid Them)

The Most Common Car Breakdowns of 2025 (And How to Avoid Them) Mazda Extended Warranty: Your Comprehensive Guide

Mazda Extended Warranty: Your Comprehensive Guide Supercar Dreams on a Budget: The Most Affordable Exotics for First-Time Buyers

Supercar Dreams on a Budget: The Most Affordable Exotics for First-Time Buyers Porsche Cayenne Engine Problems: What to Watch For

Porsche Cayenne Engine Problems: What to Watch For The Future of Racing: Electric Cars, Autonomous Vehicles, and Beyond

The Future of Racing: Electric Cars, Autonomous Vehicles, and Beyond We've Moved! Noble Quote's New Home at the Lake of the Ozarks

We've Moved! Noble Quote's New Home at the Lake of the Ozarks Warranty Myths Busted: Don't Fall for These Common Misconceptions

Warranty Myths Busted: Don't Fall for These Common Misconceptions The "New Car Smell" Doesn't Last Forever: Protecting Your Investment Long-Term

The "New Car Smell" Doesn't Last Forever: Protecting Your Investment Long-Term Forza: The Perfect Blend of Simulation and Arcade Fun

Forza: The Perfect Blend of Simulation and Arcade Fun If NASCAR Had Car Warranties: The Pit Stop Chaos You’d See

If NASCAR Had Car Warranties: The Pit Stop Chaos You’d See 5 Car Problems That’ll Make You Wish You Had an Extended Warranty

5 Car Problems That’ll Make You Wish You Had an Extended Warranty Beyond F1: Exploring the World's Most Extreme Racing Series

Beyond F1: Exploring the World's Most Extreme Racing Series The Greatest NASCAR Rivalries of All Time: On-Track Battles and Off-Track Drama

The Greatest NASCAR Rivalries of All Time: On-Track Battles and Off-Track Drama Chevy Suburban Repair Guide: Common Problems

Chevy Suburban Repair Guide: Common Problems Cupid's Got Horsepower: Rev Up Your Valentine's Day!

Cupid's Got Horsepower: Rev Up Your Valentine's Day! 10 Things You Didn't Know About James Bond’s Aston Martin DB5

10 Things You Didn't Know About James Bond’s Aston Martin DB5 Knight Rider vs. Back to the Future: A Battle of the 80s Icons

Knight Rider vs. Back to the Future: A Battle of the 80s Icons Cadillac Escalade: Mastering the Maintenance

Cadillac Escalade: Mastering the Maintenance Noble Quote vs. Omega Auto Care: Which Auto Warranty Is Right for You?

Noble Quote vs. Omega Auto Care: Which Auto Warranty Is Right for You? Charging Your Peace of Mind: Using a Credit Card to Buy a Car Warranty

Charging Your Peace of Mind: Using a Credit Card to Buy a Car Warranty Best Extended Warranty for Your Ford: Noble Quote or Ford Protect?

Best Extended Warranty for Your Ford: Noble Quote or Ford Protect? Extended Warranty vs. Self-Insuring: Which Is Right for You?

Extended Warranty vs. Self-Insuring: Which Is Right for You? Don’t Buy a Honda Warranty Before Reading This! Noble Quote vs. HondaCare

Don’t Buy a Honda Warranty Before Reading This! Noble Quote vs. HondaCare Mercedes-Benz G-Class Review: On and Off-Road Performance, Features, and Price

Mercedes-Benz G-Class Review: On and Off-Road Performance, Features, and Price CarMax MaxCare vs. Noble Quote: Extended Warranty Showdown

CarMax MaxCare vs. Noble Quote: Extended Warranty Showdown Affordable Protection: Noble Quote vs. Autopom Warranty Pricing

Affordable Protection: Noble Quote vs. Autopom Warranty Pricing Top 5 Most Expensive Car Repairs Your Manufacturer Warranty WON'T Cover

Top 5 Most Expensive Car Repairs Your Manufacturer Warranty WON'T Cover From Referrals to Reviews: Finding the Perfect Repair Shop for You

From Referrals to Reviews: Finding the Perfect Repair Shop for You Speaking Car: How to Clearly Communicate with Your Mechanic

Speaking Car: How to Clearly Communicate with Your Mechanic Selling Your Soul for an Extended Car Warranty (And Why They Keep Calling)

Selling Your Soul for an Extended Car Warranty (And Why They Keep Calling) Level Up Your EV Charging Knowledge: A Guide to Charger Types

Level Up Your EV Charging Knowledge: A Guide to Charger Types Why Is My Car Heater Blowing Cold Air?

Why Is My Car Heater Blowing Cold Air? Bumper to Bumper Extended Warranty: What Does it Really Mean?

Bumper to Bumper Extended Warranty: What Does it Really Mean? Is Cruise Control REALLY Saving You Fuel? The Truth Revealed

Is Cruise Control REALLY Saving You Fuel? The Truth Revealed What to Do When the Dealership Makes Warranty Cancellation a Hassle

What to Do When the Dealership Makes Warranty Cancellation a Hassle Boost Your EV's Range: Tips and Tricks for Maximum Mileage

Boost Your EV's Range: Tips and Tricks for Maximum Mileage Why Can’t I Include My Warranty in My Car Financing? Answers to Your Top Questions

Why Can’t I Include My Warranty in My Car Financing? Answers to Your Top Questions