Yes, you can earn income through peer-to-peer rentals (e.g., Turo), rideshare services (Uber, Lyft), delivery driving, vehicle advertising wraps, and vehicle-to-grid (V2G) programs for EVs.

In the traditional view, cars were considered money pits. The moment you drove off the lot, depreciation kicked in, and your shiny new ride started losing value. But in the new automotive economy, that’s changing. With smarter tools, new technologies, and emerging platforms, your personal vehicle isn’t just a convenience—it’s a potential revenue-generating asset.

In this guide, we’ll unpack how to flip the narrative from car depreciation to appreciation. We’ll explore creative and practical ways to monetize your car, reduce car ownership costs, and even turn your vehicle into a source of income—all while planning smarter for the total cost of ownership over time.

Welcome to the future of car financial planning.

Understanding the True Cost of Car Ownership

Before we can talk about profits, we need to address the basics: car ownership costs.

According to AAA, the average total cost of ownership (TCO) for a new car in 2024 is over $12,000 annually. That includes:

- Auto finance payments

- Insurance

- Fuel or electricity

- Maintenance and repairs

- Depreciation (the biggest hidden cost)

For years, depreciation was accepted as unavoidable. But as mobility models evolve and new monetization opportunities emerge, many car owners are turning the tables.

Is Your Car an Appreciating Asset?

Let’s get this out of the way: for most people, a car will not appreciate in value like a house or stock portfolio. However, specific cars—rare models, classic restorations, limited edition performance vehicles—can appreciate over time. Enthusiasts and collectors know the potential of long-term automotive investment strategies, but these are exceptions.

That said, appreciating lifecycle value doesn’t always mean literal resale price appreciation. It means maximizing value throughout ownership—through reduced costs and increased income.

Reduce Car Ownership Costs Proactively

One of the smartest ways to “earn” money from your vehicle is by avoiding unnecessary expenses.

- Proactive car maintenance can dramatically reduce lifetime repair bills and increase your car resale value.

- Investing in a vehicle service contract (VSC) or extended warranty can offer a strong return on investment, protecting you from high-cost repairs and stabilizing your car budget.

- Smart car financial planning tips—like comparing insurance options annually or refinancing your loan—can improve your cash flow.

Check out the Noble Quote Learning Center for free guides on how vehicle service contracts save money and reduce ownership stress.

Monetizing Your Car in the New Automotive Economy

The rise of peer-to-peer platforms has given rise to dozens of ways to make money with your car.

Peer-to-Peer Car Rentals

Platforms like Turo and Getaround let you rent out your personal vehicle when you're not using it. This model offers:

- Passive income

- Full control over when your car is available

- Potential tax deductions

Best ways to monetize your personal car? Renting it on a weekend when it's sitting idle.

Car Sharing Income & Subscriptions

Car subscription models are growing in popularity for those who want flexibility. But they’re also becoming a revenue model.

If you’re part of a fractional car ownership group or own a vehicle used in a fleet, you may receive income based on usage or equity stakes. This model may work best for urban professionals and investors who view cars as part of a larger automotive financial trend.

Your Car as a Personal Power Plant: Vehicle-to-Grid (V2G)

Electric Vehicle (EV) owners have a unique opportunity: leveraging their car battery for income.

Vehicle-to-Grid (V2G) technology allows your EV to send unused electricity back to the grid. While this tech is still scaling, pilot programs in states like California and New York are already paying EV owners for grid support.

The earning money with vehicle-to-grid model is expected to grow exponentially as utilities adopt more smart-grid infrastructure.

Turn Your Commute Into a Revenue Stream

Got a long drive? Put it to work.

- Ridesharing: Drive for Uber or Lyft part-time.

- Delivery services: DoorDash, Instacart, and Amazon Flex are popular.

- Advertising wrap: Companies like Wrapify and Carvertise pay you to place ads on your car.

Each of these methods requires different levels of commitment. But if you’re already on the road, you might as well explore ways to turn your car into a revenue source.

Boost Resale Value with Smart Upkeep

Optimizing car maintenance for resale is one of the easiest and most overlooked ways to increase your ROI.

- Stick to your service schedule

- Keep service receipts and digital records

- Avoid aftermarket mods that could reduce value

- Get a professional detailing before resale

- Consider a pre-sale inspection

A well-maintained car will stand out in private sales or trade-ins and can command hundreds—or thousands—more than a neglected vehicle.

Automotive Lifestyle Arbitrage: Buy Smart, Sell Smarter

This term might sound complex, but automotive lifestyle arbitrage simply means taking advantage of timing, location, and demand to buy and sell vehicles for profit.

For example:

- Buying an in-demand pickup truck in Texas, using it for 2 years, and selling in California could net a higher return due to regional pricing differences.

- Taking advantage of tax credits, rebates, or promotional financing can lower your car ownership economics burden significantly.

Combine this with car subscription vs buying cost analyses, and you can craft a long-term car financial strategy that plays to your strengths.

Understanding Tax Implications

Whenever you're earning with your vehicle—through car sharing, vehicle-to-grid, or peer-to-peer rental—you’ll need to be aware of tax implications of monetizing your car.

Some quick tips:

- Keep mileage logs and expense records

- Track platform income (1099s will be issued)

- Speak to a tax professional about deductions or depreciation strategies

A well-informed approach can turn liabilities into deductions and maximize the financial advantages of well-maintained vehicles.

The Shift Toward New Ownership Models

According to McKinsey’s 2023 report on the future of car ownership, we’re entering a transition. Millennials and Gen Z are far less likely to see car ownership as a symbol of success and more as a financial tool to be optimized.

Emerging new car ownership models include:

- Car subscriptions with bundled maintenance and insurance

- Shared ownership with app-based access

- Corporate car cooperatives

- Smart lease-to-earn platforms

Each of these brings new ways to reduce risk, earn revenue, and control costs—if you understand how to leverage them.

Conclusion: Rethinking the Lifecycle of Your Vehicle

The automotive economy is no longer one-directional. Your vehicle doesn't have to be a depreciating liability. With the right strategies, it can be:

- A tax-advantaged business asset

- A rental income source

- A power grid contributor

- A rideshare side hustle

- A profitable sale

The key is to stop thinking of your car as a simple tool and start treating it like a financial asset with strategic potential.

Want help planning your vehicle’s financial lifecycle or understanding your options? Visit the Noble Quote Learning Center to explore tools, protection plans, and expert guides designed for today’s car owner.

Smart Ways to Monetize Your Car and Maximize Its Financial Value: People-First Answers to Your Top Questions

Can I really make money with my personal car?

What is the total cost of car ownership, and how can I reduce it?

Total ownership includes your loan, insurance, fuel, maintenance, and depreciation. Reduce costs by maintaining your vehicle regularly, comparing insurance rates, and using vehicle service contracts to avoid major repair bills.

How do peer-to-peer car rentals work?

Platforms like Turo and Getaround allow you to list your car for rent. You choose availability, pricing, and usage limits. Income varies based on location and car type.

Is it possible for a car to appreciate in value?

Most cars depreciate, but rare, classic, or limited-production models can appreciate. More commonly, you can increase lifecycle value through income and smart upkeep.

What is vehicle-to-grid (V2G) and how do I earn money from it?

V2G allows electric vehicles to supply unused power back to the grid. Utilities in certain states offer compensation for this service, creating a passive income opportunity for EV owners.

Is fractional car ownership a good investment?

Fractional ownership lets you co-own a vehicle with others. It reduces individual costs and, in some models, allows for income generation. Profitability depends on the structure and usage.

How can I increase my car’s resale value?

Keep up with scheduled maintenance, save all service records, avoid excessive modifications, and ensure a clean, well-documented condition when selling or trading in.

Are car subscriptions cheaper than buying?

Subscriptions offer flexibility and bundled services, but they are often more expensive long-term than owning—unless you need a short-term or low-commitment solution.

What are the tax implications of monetizing my vehicle?

Income from renting, driving, or V2G programs is taxable. However, you may qualify for deductions on expenses like mileage, insurance, and maintenance. Consult a tax professional.

Do vehicle service contracts really save money?

Yes. For many drivers, vehicle service contracts protect against high repair costs, offering peace of mind and helping to control long-term ownership expenses.

Suggestions for you

Read MoreLet’s work together

Every week we showcase three charitable organizations that our donations are sent to. Our clients are able to choose which of these three will receive their gift when they add coverage to their vehicle...

Beyond the Hood: Decoding Your Car's Invisible Language (and Why It Matters to Your Wallet)

Beyond the Hood: Decoding Your Car's Invisible Language (and Why It Matters to Your Wallet) The Metaverse of Mayhem: How Virtual Driving & AI Simulations Are Rewriting Auto Insurance

The Metaverse of Mayhem: How Virtual Driving & AI Simulations Are Rewriting Auto Insurance Don’t Get Scammed: Why Reading Your VSC Contract is Your #1 Defense

Don’t Get Scammed: Why Reading Your VSC Contract is Your #1 Defense Short Bed vs. Long Bed Trucks: The Ultimate Comparison Guide for 2025

Short Bed vs. Long Bed Trucks: The Ultimate Comparison Guide for 2025 How to Pump Gas: A Complete Step-by-Step Guide for Every Driver

How to Pump Gas: A Complete Step-by-Step Guide for Every Driver The Ultimate Guide to Subprime Auto Financing: Your Path to Car Ownership

The Ultimate Guide to Subprime Auto Financing: Your Path to Car Ownership The Ultimate Hummer H2 Buyer’s Guide: Common Problems, Reliability, and What to Know Before You Buy

The Ultimate Hummer H2 Buyer’s Guide: Common Problems, Reliability, and What to Know Before You Buy The #1 Reason the 2015 Toyota Corolla Still Dominates Used Car Sales (And Why You Need One)

The #1 Reason the 2015 Toyota Corolla Still Dominates Used Car Sales (And Why You Need One) Stop The Steal: Your Ultimate Guide to Catalytic Converter Theft Prevention

Stop The Steal: Your Ultimate Guide to Catalytic Converter Theft Prevention Lost Keys? Noble Quote Has You Covered (and More!)

Lost Keys? Noble Quote Has You Covered (and More!) The True Cost of Owning a G80 BMW M3: Beyond the Sticker Price

The True Cost of Owning a G80 BMW M3: Beyond the Sticker Price The Digital Garage for Your Dollars: Navigating the World of Trading Apps

The Digital Garage for Your Dollars: Navigating the World of Trading Apps O'Reilly Auto Parts: Your Comprehensive Guide to Services, Products, and More

O'Reilly Auto Parts: Your Comprehensive Guide to Services, Products, and More Land Cruiser 2025: Unleashed & Uncosted!

Land Cruiser 2025: Unleashed & Uncosted! Noble Quote vs. Amber: Which Automotive Service Offers the Best Value?

Noble Quote vs. Amber: Which Automotive Service Offers the Best Value? Unlock Lower Rates: Your Guide to Travelers Auto Insurance Discounts

Unlock Lower Rates: Your Guide to Travelers Auto Insurance Discounts Porsche Macan: The REAL Cost of Ownership (2015–2024 Review)

Porsche Macan: The REAL Cost of Ownership (2015–2024 Review) Land Rover Evoque Review (2012–2024): True Cost of Ownership Revealed

Land Rover Evoque Review (2012–2024): True Cost of Ownership Revealed Your Car as an NFT? The Future of Automotive Ownership on Ethereum

Your Car as an NFT? The Future of Automotive Ownership on Ethereum Unlock Cheaper Rates: Your Ultimate Guide to State Farm Auto Insurance Discounts

Unlock Cheaper Rates: Your Ultimate Guide to State Farm Auto Insurance Discounts Online Used Car Shopping: What You NEED to Know Before You Buy

Online Used Car Shopping: What You NEED to Know Before You Buy Can You Afford the 6th Gen Camaro? A True Cost Breakdown

Can You Afford the 6th Gen Camaro? A True Cost Breakdown The 7 Hidden Costs of Skipping Your Extended Car Warranty

The 7 Hidden Costs of Skipping Your Extended Car Warranty Reborn Rugged: Why the Ineos Grenadier is More Than Just an SUV

Reborn Rugged: Why the Ineos Grenadier is More Than Just an SUV AutoZone: Your DIY Partner or a Pro's Pit Stop? A Comprehensive Review

AutoZone: Your DIY Partner or a Pro's Pit Stop? A Comprehensive Review Factors Affecting Your Car Insurance Rates: The Ultimate Guide to Understanding Costs

Factors Affecting Your Car Insurance Rates: The Ultimate Guide to Understanding Costs How to Maximize Your Car Trade-In Value: The Ultimate Guide

How to Maximize Your Car Trade-In Value: The Ultimate Guide BYD Cars 2025: Your Ultimate Guide to the Full Lineup & Latest Innovations

BYD Cars 2025: Your Ultimate Guide to the Full Lineup & Latest Innovations The Importance of Wheel Alignment and Balancing: Smooth Driving and Tire Longevity

The Importance of Wheel Alignment and Balancing: Smooth Driving and Tire Longevity Farmers Auto Insurance: Your Ultimate 2025 Guide to Coverage, Rates & Savings

Farmers Auto Insurance: Your Ultimate 2025 Guide to Coverage, Rates & Savings Don't Miss Out: How to Buy Crypto Before the Next FOMO Wave (2025 Guide)

Don't Miss Out: How to Buy Crypto Before the Next FOMO Wave (2025 Guide) Brake Pads: The Science of Stopping (How They're Made, What They Do, & Signs of Wear)

Brake Pads: The Science of Stopping (How They're Made, What They Do, & Signs of Wear) Spark Plugs: The Tiny Titans That Ignite Your Engine

Spark Plugs: The Tiny Titans That Ignite Your Engine The Ultimate Showdown: Car Broker vs. DIY Car Buying – Which Path Saves You More?

The Ultimate Showdown: Car Broker vs. DIY Car Buying – Which Path Saves You More? Kelley Blue Book Instant Cash Offer: Your Ultimate Guide to Getting Top Dollar for Your Car

Kelley Blue Book Instant Cash Offer: Your Ultimate Guide to Getting Top Dollar for Your Car Oxygen Sensors: The 'Eyes' of Your Engine (Their Role, What Goes Wrong, & Why They Matter)

Oxygen Sensors: The 'Eyes' of Your Engine (Their Role, What Goes Wrong, & Why They Matter) Carvana vs. Traditional Dealerships: The Ultimate Showdown for Your Next Car Purchase

Carvana vs. Traditional Dealerships: The Ultimate Showdown for Your Next Car Purchase Full Tort vs. Limited Tort Auto Insurance: The Ultimate Guide to Protecting Your Rights & Payout

Full Tort vs. Limited Tort Auto Insurance: The Ultimate Guide to Protecting Your Rights & Payout CV Axles: Putting Power to the Wheels (What They Do, Signs of Wear, & When to Replace)

CV Axles: Putting Power to the Wheels (What They Do, Signs of Wear, & When to Replace) 10 Essential Car Prep Tips for Your Family’s Epic Summer Road Trips (2025 Edition)

10 Essential Car Prep Tips for Your Family’s Epic Summer Road Trips (2025 Edition) DriveTime Review 2024/2025: Your Complete A–Z Guide to Buying a Car There

DriveTime Review 2024/2025: Your Complete A–Z Guide to Buying a Car There Rideshare Riches: How Much Can YOU Really Earn Driving for Uber & Lyft in 2025?

Rideshare Riches: How Much Can YOU Really Earn Driving for Uber & Lyft in 2025? The Car Computer (ECM/ECU): The Brain of Your Vehicle (Its Functions, Troubleshooting, & Updates)

The Car Computer (ECM/ECU): The Brain of Your Vehicle (Its Functions, Troubleshooting, & Updates) The Ultimate Truck/SUV Beach Driving Guide: Prep, Safety, & Post-Sand Care

The Ultimate Truck/SUV Beach Driving Guide: Prep, Safety, & Post-Sand Care The Mass Airflow Sensor (MAF): Engine's Air Traffic Controller (Function, Symptoms of Failure, & Cleaning)

The Mass Airflow Sensor (MAF): Engine's Air Traffic Controller (Function, Symptoms of Failure, & Cleaning) Car Coolant Flush: The Ultimate Guide to a Healthy Engine & Extended Vehicle Life

Car Coolant Flush: The Ultimate Guide to a Healthy Engine & Extended Vehicle Life Serpentine Belt: Powering Your Car's Accessories (Its Job, Signs of Wear, & Replacement)

Serpentine Belt: Powering Your Car's Accessories (Its Job, Signs of Wear, & Replacement) BMW M2: The Pure Driving Machine Reborn?

BMW M2: The Pure Driving Machine Reborn? The Reigning Champion: Why the 2025 Ford Ranger is North America's Truck of the Year

The Reigning Champion: Why the 2025 Ford Ranger is North America's Truck of the Year The Ultimate Protection Plan: How Life Insurance Drives Your Family’s Future

The Ultimate Protection Plan: How Life Insurance Drives Your Family’s Future Power Steering System: Effortless Control (How It Works, Common Issues, & Maintenance Tips)

Power Steering System: Effortless Control (How It Works, Common Issues, & Maintenance Tips) End-of-Month Car Deals: Myth or Money-Saver?

End-of-Month Car Deals: Myth or Money-Saver? NobleQuote.com Presents: American National Auto Insurance – Your Complete Guide

NobleQuote.com Presents: American National Auto Insurance – Your Complete Guide Edmunds.com: Your Ultimate Guide to Smarter Car Buying

Edmunds.com: Your Ultimate Guide to Smarter Car Buying The Definitive Guide to Frank Martin's Cars in The Transporter Series

The Definitive Guide to Frank Martin's Cars in The Transporter Series Pre-Existing Conditions and Home Warranties: What You Need to Know Before You Buy

Pre-Existing Conditions and Home Warranties: What You Need to Know Before You Buy Why Your Car Insurance is Skyrocketing in 2025 (and How NobleQuote Can Help)

Why Your Car Insurance is Skyrocketing in 2025 (and How NobleQuote Can Help) Clutch: Manual Transmission’s Master Link (How It Transfers Power, Signs of Wear, & Replacement)

Clutch: Manual Transmission’s Master Link (How It Transfers Power, Signs of Wear, & Replacement) The 2025 Toyota Supra: The Grand Finale of a Legend?

The 2025 Toyota Supra: The Grand Finale of a Legend? Teen Driver Car Insurance Costs & Strategies: How to Get Affordable Coverage for Young Drivers

Teen Driver Car Insurance Costs & Strategies: How to Get Affordable Coverage for Young Drivers Is Your Car Insurance Enough? Unexpected Repairs and the Peace of Mind of a NobleQuote Vehicle Service Contract

Is Your Car Insurance Enough? Unexpected Repairs and the Peace of Mind of a NobleQuote Vehicle Service Contract Esurance Auto Insurance Review 2025: Is It the Right Digital Fit for Your Ride?

Esurance Auto Insurance Review 2025: Is It the Right Digital Fit for Your Ride? Cabin Air Filter: Breathing Easy in Your Car (What It Does, Why It Matters, & When to Replace)

Cabin Air Filter: Breathing Easy in Your Car (What It Does, Why It Matters, & When to Replace) Don't Let a Blown Engine Derail Your Life: The Auto Pro's Guide to Disability Insurance

Don't Let a Blown Engine Derail Your Life: The Auto Pro's Guide to Disability Insurance Godzilla’s Reign: Unpacking the Legend of the 5th Gen Nissan GT-R

Godzilla’s Reign: Unpacking the Legend of the 5th Gen Nissan GT-R Car Fuses: The Unsung Heroes of Your Electrical System (What They Do, Common Failures, & How to Replace)

Car Fuses: The Unsung Heroes of Your Electrical System (What They Do, Common Failures, & How to Replace) Protect Your Ride & Your Family: Why Northwestern Mutual Life Insurance Matters for Car Owners

Protect Your Ride & Your Family: Why Northwestern Mutual Life Insurance Matters for Car Owners Unlock 200,000 Miles: The Ultimate Preventative Car Maintenance Schedule & Checklist

Unlock 200,000 Miles: The Ultimate Preventative Car Maintenance Schedule & Checklist Scout Motors: The American Icon Reborn for the Electric Age

Scout Motors: The American Icon Reborn for the Electric Age How to Replace Wiper Blades: A Step-by-Step DIY Guide (Save Money & See Clearly!)

How to Replace Wiper Blades: A Step-by-Step DIY Guide (Save Money & See Clearly!) The Ultimate Guide to Cheap Car Insurance: Find Your Lowest Rates in 2025

The Ultimate Guide to Cheap Car Insurance: Find Your Lowest Rates in 2025 The 2025 Automotive Retirement Number: What Auto Pros Need to Save for a Comfortable Ride

The 2025 Automotive Retirement Number: What Auto Pros Need to Save for a Comfortable Ride The Last Ride: Why the 2025 Audi A4 is the Ultimate Collectible (and Daily Driver)

The Last Ride: Why the 2025 Audi A4 is the Ultimate Collectible (and Daily Driver) Unearthing Automotive Gold: The Underrated Used Cars You Need to Buy Now

Unearthing Automotive Gold: The Underrated Used Cars You Need to Buy Now Pre-Purchase Inspection (PPI): Your Essential Checklist Before Buying Any Used Car

Pre-Purchase Inspection (PPI): Your Essential Checklist Before Buying Any Used Car 2025 Corvette ZR1: The Ultimate Guide to Specs, Price, and Performance

2025 Corvette ZR1: The Ultimate Guide to Specs, Price, and Performance Headlight Restoration & Bulb Replacement: The Ultimate Guide to Perfect Car Lighting

Headlight Restoration & Bulb Replacement: The Ultimate Guide to Perfect Car Lighting Does Driving for Uber/Lyft/DoorDash Void Your Car’s Warranty? & How to Get Covered

Does Driving for Uber/Lyft/DoorDash Void Your Car’s Warranty? & How to Get Covered The Ultimate Guide to Motorcycle Extended Warranties: Is It Worth It for Your Ride?

The Ultimate Guide to Motorcycle Extended Warranties: Is It Worth It for Your Ride? 2025 BMW X7 vs. Mercedes-Benz GLS: Which Luxury SUV Reigns Supreme?

2025 BMW X7 vs. Mercedes-Benz GLS: Which Luxury SUV Reigns Supreme? Barbie's Dream Car: The Ultimate EV Conversion? (And Why Even Fantasy Needs a Real Warranty)

Barbie's Dream Car: The Ultimate EV Conversion? (And Why Even Fantasy Needs a Real Warranty) Blown Head Gasket: The $2,500+ Repair Nightmare That Catches Car Owners Off Guard – Learn How to Prepare

Blown Head Gasket: The $2,500+ Repair Nightmare That Catches Car Owners Off Guard – Learn How to Prepare 2025 Cadillac Lyriq Review: The Ultimate Luxury Electric SUV?

2025 Cadillac Lyriq Review: The Ultimate Luxury Electric SUV? Pep Boys: Your Complete Guide to Auto Parts, Service & Repair (2025 Edition)

Pep Boys: Your Complete Guide to Auto Parts, Service & Repair (2025 Edition) Drive Smarter: Unlock Vehicle Protection with 0% APR Service Contract Payments

Drive Smarter: Unlock Vehicle Protection with 0% APR Service Contract Payments 2025 Harley-Davidson Sportster S: The Ultimate Review & Buyer’s Guide

2025 Harley-Davidson Sportster S: The Ultimate Review & Buyer’s Guide New Jersey Car Insurance Laws 2025–2026: Your Essential Guide to What’s Changed & What’s Next

New Jersey Car Insurance Laws 2025–2026: Your Essential Guide to What’s Changed & What’s Next The Ultimate Dodge Viper Guide: All Generations, Specs, & History (1991–2017)

The Ultimate Dodge Viper Guide: All Generations, Specs, & History (1991–2017) Meineke Oil Change: Everything You Need to Know (Prices, Packages, and Why It Matters)

Meineke Oil Change: Everything You Need to Know (Prices, Packages, and Why It Matters) The Connected Car’s 'Black Box': How Your Data Impacts Warranty Claims

The Connected Car’s 'Black Box': How Your Data Impacts Warranty Claims 2025 Porsche Taycan: The Ultimate Guide to Porsche's Electrifying Evolution

2025 Porsche Taycan: The Ultimate Guide to Porsche's Electrifying Evolution Automatic vs. Hand Wash: Which is Truly Safer for Your Car's Finish?

Automatic vs. Hand Wash: Which is Truly Safer for Your Car's Finish? The Ultimate Toyota RAV4 Guide: Every Generation Explored (1994–Present)

The Ultimate Toyota RAV4 Guide: Every Generation Explored (1994–Present) Homeowners Insurance vs. Home Warranty: A Clear Breakdown for Every Homeowner

Homeowners Insurance vs. Home Warranty: A Clear Breakdown for Every Homeowner Erie Auto Insurance Review 2025: Rates, Discounts, & Why Drivers Choose It

Erie Auto Insurance Review 2025: Rates, Discounts, & Why Drivers Choose It The Ultimate Bentley Bentayga Buyer’s Guide: Every Model, Trim & Real-World Ownership Costs

The Ultimate Bentley Bentayga Buyer’s Guide: Every Model, Trim & Real-World Ownership Costs The Ultimate Lamborghini Urus Buyer's Guide: Every Generation, Model, & What You Need to Know Before Owning

The Ultimate Lamborghini Urus Buyer's Guide: Every Generation, Model, & What You Need to Know Before Owning Mazda6 Generations Explained: A Complete History & Buyer's Guide (All Models)

Mazda6 Generations Explained: A Complete History & Buyer's Guide (All Models) The True Cost of Luxury Car Repair: Are You Paying Too Much Without a Vehicle Service Contract?

The True Cost of Luxury Car Repair: Are You Paying Too Much Without a Vehicle Service Contract? Chubb Auto Insurance: The Premier Choice for Luxury, Exotic, and Classic Cars

Chubb Auto Insurance: The Premier Choice for Luxury, Exotic, and Classic Cars Full Tort vs. Limited Tort in Pennsylvania: Which is Right for You? (A Driver's Definitive Guide)

Full Tort vs. Limited Tort in Pennsylvania: Which is Right for You? (A Driver's Definitive Guide) Cash vs. Car Loan: Which is Right for Your Next Vehicle Purchase?

Cash vs. Car Loan: Which is Right for Your Next Vehicle Purchase? Don't Get Ripped Off: Your Complete Guide to Smart Car Repairs

Don't Get Ripped Off: Your Complete Guide to Smart Car Repairs The New Land Rover Defender: Redefining Rugged Luxury (Your Ultimate Review & Buying Guide)

The New Land Rover Defender: Redefining Rugged Luxury (Your Ultimate Review & Buying Guide) The Silent Killer: Why Not Driving Your Car Wears It Out Faster Than You Think

The Silent Killer: Why Not Driving Your Car Wears It Out Faster Than You Think The Ultimate 2025 Hyundai Santa Fe Review: Your Complete Buyer’s Guide

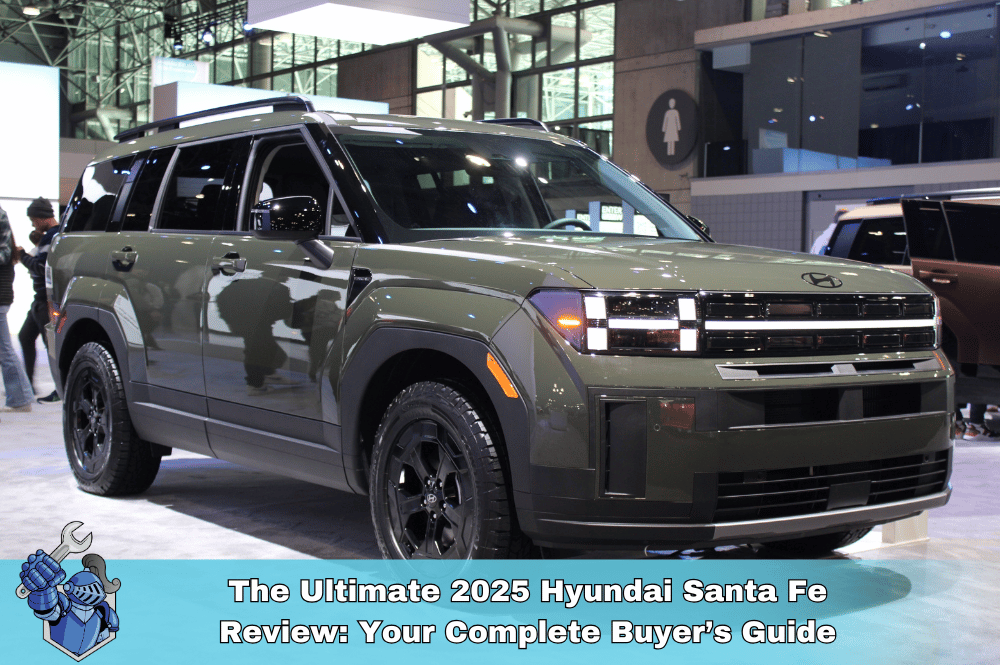

The Ultimate 2025 Hyundai Santa Fe Review: Your Complete Buyer’s Guide Beyond the Basics: Unpacking AIG's Elite Auto Insurance for High-Net-Worth Drivers

Beyond the Basics: Unpacking AIG's Elite Auto Insurance for High-Net-Worth Drivers The Repair Shop Rejection Reflex: Why Customers Say No to Essential Car Fixes

The Repair Shop Rejection Reflex: Why Customers Say No to Essential Car Fixes Rolls-Royce Cullinan Review: Is This the World's Ultimate Luxury SUV?

Rolls-Royce Cullinan Review: Is This the World's Ultimate Luxury SUV? Amica Auto Insurance Review 2025: Unpacking Value, Dividends, and Why It Consistently Ranks #1 for Service

Amica Auto Insurance Review 2025: Unpacking Value, Dividends, and Why It Consistently Ranks #1 for Service Get Your Price Instantly: The Smart Way to Buy & Manage Your Car's Extended Warranty Online with NobleQuote

Get Your Price Instantly: The Smart Way to Buy & Manage Your Car's Extended Warranty Online with NobleQuote The Ultimate 2025 Nissan Armada Buyer's Guide: Everything You Need to Know

The Ultimate 2025 Nissan Armada Buyer's Guide: Everything You Need to Know Rideshare Safety Unlocked: The Ultimate Guide to Secure Uber & Lyft Rides

Rideshare Safety Unlocked: The Ultimate Guide to Secure Uber & Lyft Rides The Ultimate Guide to Home Warranty Plumbing Coverage: What's Covered, What's Not, and Why It Matters

The Ultimate Guide to Home Warranty Plumbing Coverage: What's Covered, What's Not, and Why It Matters The End of an Era: Why the Nissan Titan Was Discontinued (And What It Means for Truck Buyers)

The End of an Era: Why the Nissan Titan Was Discontinued (And What It Means for Truck Buyers) Drive: The Ryan Gosling Movie That Defined a Generation of Car Culture

Drive: The Ryan Gosling Movie That Defined a Generation of Car Culture CAN Bus Explained: How Your Car's Digital Network Connects Everything (and Why It Matters)

CAN Bus Explained: How Your Car's Digital Network Connects Everything (and Why It Matters) The Ultimate Guide to the 2025 Jaguar F-Pace: Performance, Luxury & Value

The Ultimate Guide to the 2025 Jaguar F-Pace: Performance, Luxury & Value Confessions of a Car Salesperson: What They Don’t Want You to Know (And How to Use It to Your Advantage)

Confessions of a Car Salesperson: What They Don’t Want You to Know (And How to Use It to Your Advantage) Water Damage & Your Home Warranty: Understanding What's Truly Covered (and What Isn't!)

Water Damage & Your Home Warranty: Understanding What's Truly Covered (and What Isn't!)