AI is transforming auto insurance by enabling real-time risk assessment, personalizing premiums based on driving behavior, automating claims processing, and improving fraud detection through data analytics and machine learning.

In a world where the line between digital and physical is rapidly blurring, auto insurance is entering a new era—one driven not by clipboards and claims adjusters but by AI simulations, virtual driving, and even the metaverse. The future of auto insurance is unfolding in real-time, powered by advanced analytics, machine learning, and the ever-expanding capabilities of automotive technology trends.

We’re no longer talking about minor tweaks to premiums based on age or ZIP code. Today, car insurance is being fundamentally rewritten by predictive auto insurance models, digital twins, virtual reality automotive ecosystems, and smart vehicles that generate mountains of sensor data every mile. Buckle up—this ride through the metaverse of mayhem is about to get wild.

From Paper to Pixels: A Glimpse Into Insurance Innovation

The traditional auto insurance model relied on basic demographics and historical claims data. But modern AI in insurance has flipped that script, leveraging real-time inputs, vehicle data, and behavioral modeling to create highly personalized auto premiums.

Here’s how:

- Data analytics tools assess driving habits in real-time.

- Machine learning algorithms calculate risks based on thousands of variables.

- Simulated driving insurance lets insurers test how you might behave in virtual emergencies.

- Predictive AI flags high-risk patterns before an accident occurs.

These changes aren’t theoretical—they’re already transforming insurance underwriting, fraud detection, and claims processing.

Enter the Metaverse: Where Virtual Roads Meet Real Risks

What happens when virtual reality becomes more than a game?

In platforms like the metaverse, users can simulate real-world driving in immersive 3D environments. Think of it as a virtual driving test, only now, your performance could directly impact your auto insurance rates.

Some insurers are exploring how metaverse car insurance might offer insurance discounts for virtual driving, especially for younger drivers who may not yet have real-world driving records. Gamified systems like this could reward safe behaviors—think turn signals, full stops, and obeying speed limits—with real-world car insurance savings.

These gamified insurance rewards programs could be the foundation for new insurance models by 2030.

Digital Twins & Simulated Drivers: A New Kind of Risk Profile

A digital twin vehicle is a virtual replica of your car that mirrors its condition, use, and performance in real-time using sensor data and telematics. Insurers can now simulate:

- Engine performance

- Brake response

- Driver reaction times

- External conditions

This data enables highly accurate insurance risk assessments using AI. For instance, insurers can test how your digital twin performs in icy conditions or high-speed braking scenarios. This isn't just cool tech—it has life-saving potential.

Cyber Insurance for Cars: A Growing Concern in a Connected World

The rise of connected vehicles—those with internet-enabled systems—has introduced a new kind of vulnerability: cyberattacks. If a hacker disables your car’s steering or brakes remotely, who's liable?

This is where cyber insurance for cars steps in. It covers:

- Losses from system breaches

- Data theft

- Unauthorized access

- Ransomware on infotainment or navigation systems

As autonomous vehicles become more common, cyber security risks for connected cars insurance will only grow in relevance. Insurance innovation is now as much about protecting data as it is about covering dents and dings.

AI Claims Processing: Speed Meets Accuracy

After an accident, AI claims processing systems can:

- Analyze images of vehicle damage

- Estimate repair costs instantly

- Compare against historical data

- Reduce fraud

This significantly shortens the claims cycle and increases customer satisfaction. With the help of deep learning, some platforms are now making accurate estimates in under 10 seconds. For insurers, it cuts costs. For drivers, it slashes waiting times.

Ethical Implications: The Invisible Hand Behind the Premium

While AI auto insurance offers unprecedented precision, it also raises tough questions:

- What are the ethical concerns of AI in car insurance?

Bias in algorithms can unfairly penalize certain drivers based on location or socio-economic status. - What is predictive policing in auto insurance?

This concept involves denying or increasing rates based on a predicted risk of an accident—even if the accident hasn’t occurred. It's controversial, and regulators are taking notice.

Transparency will be critical. Consumers deserve to know how their driving behavior scores are calculated and whether they’re being profiled unfairly.

New Frontiers: Extended Reality and Smart Contract Insurance

Extended reality (XR) is blending the physical and digital driving experience even further. Some programs are experimenting with real-time overlays to correct driving behavior as it happens. Imagine a heads-up display nudging you to slow down in school zones—before you even see the sign.

Meanwhile, blockchain-powered smart contract insurance is automating how and when policies activate or expire, how payouts are made, and how usage data is stored. This decentralizes trust and could remove friction between drivers, insurers, and service centers.

Usage-Based Insurance (UBI): Past, Present, and Virtual Future

UBI models like telematics insurance aren’t new—but their virtual future is. In the metaverse, your simulated behavior in dynamic scenarios could provide more precise inputs than real-world data.

How does simulated driving reduce accident risk?

Drivers can be trained to handle high-stress or rare scenarios (hydroplaning, sudden stops) through immersive practice.

Can I get an insurance discount for virtual driving?

Some insurers are already piloting these programs. Your performance in VR environments could soon qualify you for reduced premiums.

Future of UBI with virtual reality is about tailoring policies based not just on what you've done—but what you can prove you’re capable of doing.

How AI Is Reshaping Auto Insurance: Quick Q&A

How is AI changing auto insurance?

AI allows insurers to personalize rates, detect fraud, speed up claims, and predict accidents before they happen.

Will virtual reality impact car insurance rates?

Yes, especially as VR is used for training, risk assessments, and simulated driving behavior evaluations.

What is predictive auto insurance?

It’s a model that uses AI and machine learning to anticipate a driver's likelihood of filing a claim, adjusting premiums accordingly.

What is cyber insurance for connected vehicles?

A policy that protects drivers from digital threats like hacking or data breaches in internet-enabled vehicles.

How do AI simulations affect car insurance premiums?

Simulations provide more precise data on how drivers handle risky situations, leading to more accurate pricing.

How will the metaverse influence car insurance?

The metaverse will allow drivers to demonstrate skills, reduce rates through gamification, and help insurers model risk with greater nuance.

Are gamified driving apps recognized by insurers?

Some are—especially those that tie directly into telematics or simulate realistic driving behavior.

How do insurers use vehicle data for risk assessment?

They evaluate acceleration, braking, steering, and usage patterns to predict risk and customize premiums.

What is the role of AI in auto insurance claims?

AI speeds up claims review, automates approvals, and detects anomalies that may indicate fraud.

What is a digital twin in automotive insurance?

It’s a virtual copy of your car, used by insurers to simulate and evaluate performance, wear, and driver interaction.

The Road to 2030: What Comes Next?

By 2030, we could see:

- Fully automated claims triggered the moment your car is damaged

- Driverless car insurance tailored for owners who never touch the wheel

- Personalization based on biometric stress responses during simulations

- Policy customization using AI feedback from daily driving

These aren’t guesses—they’re active developments being pursued by leaders in insurtech, auto manufacturing, and digital mobility platforms.

Final Thoughts: Adapt or Get Left Behind

The transformation of auto insurance is not just about technology—it’s about redefining how we understand risk, behavior, and responsibility. With virtual driving, AI simulations, and metaverse integrations at the forefront, the road ahead is full of possibility.

Insurers who embrace this evolution will gain a competitive edge. Drivers who understand it will be empowered with better, more affordable protection. And platforms like Noble Quote will continue to guide you through these shifts with clarity and confidence.

Want to stay ahead of the curve?

Visit the Noble Quote Learning Center for more insights into emerging trends, expert advice, and real-world guidance on everything from tech innovations to traditional coverage.

Top Questions About AI, the Metaverse, and the Future of Auto Insurance—Answered

How is AI changing auto insurance?

Will virtual reality impact car insurance rates?

Yes, virtual reality is being used to simulate driving behavior, allowing insurers to evaluate risk more accurately. Safe virtual driving performance could lead to insurance discounts in the future.

What is predictive auto insurance?

Predictive auto insurance uses AI algorithms to analyze data from sensors, driving history, and simulations to forecast future claim risk and set premiums accordingly.

How do AI simulations affect car insurance premiums?

AI simulations can assess how a driver would react in critical scenarios, like sudden braking or bad weather. This data helps insurers adjust premiums based on predicted safety and response behaviors.

What is cyber insurance for connected vehicles?

Cyber insurance covers losses related to data breaches, hacks, and system failures in internet-connected vehicles, including infotainment systems, GPS, and autonomous driving features.

Can I get an insurance discount for virtual driving?

Some insurers are testing programs that offer discounts based on safe performance in virtual driving environments, particularly for younger or less experienced drivers.

How will the metaverse influence car insurance?

The metaverse may allow for immersive driver training, risk modeling, and behavioral assessments, which insurers can use to refine policies and pricing more accurately.

What are the ethical concerns of AI in car insurance?

Key concerns include algorithmic bias, lack of transparency in rate-setting, and the use of personal data in predictive modeling, which may unfairly disadvantage certain groups.

How do insurers use vehicle data for risk assessment?

Insurers analyze telematics data—like speed, braking, and cornering habits—to create a driving behavior profile, which directly influences premium costs and coverage options.

What is a digital twin in automotive insurance?

A digital twin is a virtual replica of your vehicle that updates in real-time based on sensor data. It’s used by insurers to simulate wear, driving conditions, and accident likelihood for more precise underwriting.

Suggestions for you

Read MoreLet’s work together

Every week we showcase three charitable organizations that our donations are sent to. Our clients are able to choose which of these three will receive their gift when they add coverage to their vehicle...

Beyond the Hood: Decoding Your Car's Invisible Language (and Why It Matters to Your Wallet)

Beyond the Hood: Decoding Your Car's Invisible Language (and Why It Matters to Your Wallet) From Depreciation to Appreciation: Monetizing Your Car's Lifecycle in the New Automotive Economy

From Depreciation to Appreciation: Monetizing Your Car's Lifecycle in the New Automotive Economy Don’t Get Scammed: Why Reading Your VSC Contract is Your #1 Defense

Don’t Get Scammed: Why Reading Your VSC Contract is Your #1 Defense Short Bed vs. Long Bed Trucks: The Ultimate Comparison Guide for 2025

Short Bed vs. Long Bed Trucks: The Ultimate Comparison Guide for 2025 How to Pump Gas: A Complete Step-by-Step Guide for Every Driver

How to Pump Gas: A Complete Step-by-Step Guide for Every Driver The Ultimate Guide to Subprime Auto Financing: Your Path to Car Ownership

The Ultimate Guide to Subprime Auto Financing: Your Path to Car Ownership The Ultimate Hummer H2 Buyer’s Guide: Common Problems, Reliability, and What to Know Before You Buy

The Ultimate Hummer H2 Buyer’s Guide: Common Problems, Reliability, and What to Know Before You Buy The #1 Reason the 2015 Toyota Corolla Still Dominates Used Car Sales (And Why You Need One)

The #1 Reason the 2015 Toyota Corolla Still Dominates Used Car Sales (And Why You Need One) Stop The Steal: Your Ultimate Guide to Catalytic Converter Theft Prevention

Stop The Steal: Your Ultimate Guide to Catalytic Converter Theft Prevention Unlock Cheaper Rates: Your Ultimate Guide to State Farm Auto Insurance Discounts

Unlock Cheaper Rates: Your Ultimate Guide to State Farm Auto Insurance Discounts Online Used Car Shopping: What You NEED to Know Before You Buy

Online Used Car Shopping: What You NEED to Know Before You Buy Can You Afford the 6th Gen Camaro? A True Cost Breakdown

Can You Afford the 6th Gen Camaro? A True Cost Breakdown The 7 Hidden Costs of Skipping Your Extended Car Warranty

The 7 Hidden Costs of Skipping Your Extended Car Warranty AutoZone: Your DIY Partner or a Pro's Pit Stop? A Comprehensive Review

AutoZone: Your DIY Partner or a Pro's Pit Stop? A Comprehensive Review Reborn Rugged: Why the Ineos Grenadier is More Than Just an SUV

Reborn Rugged: Why the Ineos Grenadier is More Than Just an SUV Factors Affecting Your Car Insurance Rates: The Ultimate Guide to Understanding Costs

Factors Affecting Your Car Insurance Rates: The Ultimate Guide to Understanding Costs How to Maximize Your Car Trade-In Value: The Ultimate Guide

How to Maximize Your Car Trade-In Value: The Ultimate Guide The Importance of Wheel Alignment and Balancing: Smooth Driving and Tire Longevity

The Importance of Wheel Alignment and Balancing: Smooth Driving and Tire Longevity BYD Cars 2025: Your Ultimate Guide to the Full Lineup & Latest Innovations

BYD Cars 2025: Your Ultimate Guide to the Full Lineup & Latest Innovations Don't Miss Out: How to Buy Crypto Before the Next FOMO Wave (2025 Guide)

Don't Miss Out: How to Buy Crypto Before the Next FOMO Wave (2025 Guide) Farmers Auto Insurance: Your Ultimate 2025 Guide to Coverage, Rates & Savings

Farmers Auto Insurance: Your Ultimate 2025 Guide to Coverage, Rates & Savings Brake Pads: The Science of Stopping (How They're Made, What They Do, & Signs of Wear)

Brake Pads: The Science of Stopping (How They're Made, What They Do, & Signs of Wear) Spark Plugs: The Tiny Titans That Ignite Your Engine

Spark Plugs: The Tiny Titans That Ignite Your Engine The Ultimate Showdown: Car Broker vs. DIY Car Buying – Which Path Saves You More?

The Ultimate Showdown: Car Broker vs. DIY Car Buying – Which Path Saves You More? Kelley Blue Book Instant Cash Offer: Your Ultimate Guide to Getting Top Dollar for Your Car

Kelley Blue Book Instant Cash Offer: Your Ultimate Guide to Getting Top Dollar for Your Car Carvana vs. Traditional Dealerships: The Ultimate Showdown for Your Next Car Purchase

Carvana vs. Traditional Dealerships: The Ultimate Showdown for Your Next Car Purchase Oxygen Sensors: The 'Eyes' of Your Engine (Their Role, What Goes Wrong, & Why They Matter)

Oxygen Sensors: The 'Eyes' of Your Engine (Their Role, What Goes Wrong, & Why They Matter) Full Tort vs. Limited Tort Auto Insurance: The Ultimate Guide to Protecting Your Rights & Payout

Full Tort vs. Limited Tort Auto Insurance: The Ultimate Guide to Protecting Your Rights & Payout CV Axles: Putting Power to the Wheels (What They Do, Signs of Wear, & When to Replace)

CV Axles: Putting Power to the Wheels (What They Do, Signs of Wear, & When to Replace) 10 Essential Car Prep Tips for Your Family’s Epic Summer Road Trips (2025 Edition)

10 Essential Car Prep Tips for Your Family’s Epic Summer Road Trips (2025 Edition) DriveTime Review 2024/2025: Your Complete A–Z Guide to Buying a Car There

DriveTime Review 2024/2025: Your Complete A–Z Guide to Buying a Car There Rideshare Riches: How Much Can YOU Really Earn Driving for Uber & Lyft in 2025?

Rideshare Riches: How Much Can YOU Really Earn Driving for Uber & Lyft in 2025? The Car Computer (ECM/ECU): The Brain of Your Vehicle (Its Functions, Troubleshooting, & Updates)

The Car Computer (ECM/ECU): The Brain of Your Vehicle (Its Functions, Troubleshooting, & Updates) The Mass Airflow Sensor (MAF): Engine's Air Traffic Controller (Function, Symptoms of Failure, & Cleaning)

The Mass Airflow Sensor (MAF): Engine's Air Traffic Controller (Function, Symptoms of Failure, & Cleaning) The Ultimate Truck/SUV Beach Driving Guide: Prep, Safety, & Post-Sand Care

The Ultimate Truck/SUV Beach Driving Guide: Prep, Safety, & Post-Sand Care The Reigning Champion: Why the 2025 Ford Ranger is North America's Truck of the Year

The Reigning Champion: Why the 2025 Ford Ranger is North America's Truck of the Year Car Coolant Flush: The Ultimate Guide to a Healthy Engine & Extended Vehicle Life

Car Coolant Flush: The Ultimate Guide to a Healthy Engine & Extended Vehicle Life Serpentine Belt: Powering Your Car's Accessories (Its Job, Signs of Wear, & Replacement)

Serpentine Belt: Powering Your Car's Accessories (Its Job, Signs of Wear, & Replacement) Power Steering System: Effortless Control (How It Works, Common Issues, & Maintenance Tips)

Power Steering System: Effortless Control (How It Works, Common Issues, & Maintenance Tips) End-of-Month Car Deals: Myth or Money-Saver?

End-of-Month Car Deals: Myth or Money-Saver? NobleQuote.com Presents: American National Auto Insurance – Your Complete Guide

NobleQuote.com Presents: American National Auto Insurance – Your Complete Guide The Ultimate Protection Plan: How Life Insurance Drives Your Family’s Future

The Ultimate Protection Plan: How Life Insurance Drives Your Family’s Future BMW M2: The Pure Driving Machine Reborn?

BMW M2: The Pure Driving Machine Reborn? The Definitive Guide to Frank Martin's Cars in The Transporter Series

The Definitive Guide to Frank Martin's Cars in The Transporter Series Pre-Existing Conditions and Home Warranties: What You Need to Know Before You Buy

Pre-Existing Conditions and Home Warranties: What You Need to Know Before You Buy Edmunds.com: Your Ultimate Guide to Smarter Car Buying

Edmunds.com: Your Ultimate Guide to Smarter Car Buying Why Your Car Insurance is Skyrocketing in 2025 (and How NobleQuote Can Help)

Why Your Car Insurance is Skyrocketing in 2025 (and How NobleQuote Can Help) Clutch: Manual Transmission’s Master Link (How It Transfers Power, Signs of Wear, & Replacement)

Clutch: Manual Transmission’s Master Link (How It Transfers Power, Signs of Wear, & Replacement) The 2025 Toyota Supra: The Grand Finale of a Legend?

The 2025 Toyota Supra: The Grand Finale of a Legend? Teen Driver Car Insurance Costs & Strategies: How to Get Affordable Coverage for Young Drivers

Teen Driver Car Insurance Costs & Strategies: How to Get Affordable Coverage for Young Drivers Is Your Car Insurance Enough? Unexpected Repairs and the Peace of Mind of a NobleQuote Vehicle Service Contract

Is Your Car Insurance Enough? Unexpected Repairs and the Peace of Mind of a NobleQuote Vehicle Service Contract Esurance Auto Insurance Review 2025: Is It the Right Digital Fit for Your Ride?

Esurance Auto Insurance Review 2025: Is It the Right Digital Fit for Your Ride? Cabin Air Filter: Breathing Easy in Your Car (What It Does, Why It Matters, & When to Replace)

Cabin Air Filter: Breathing Easy in Your Car (What It Does, Why It Matters, & When to Replace) Don't Let a Blown Engine Derail Your Life: The Auto Pro's Guide to Disability Insurance

Don't Let a Blown Engine Derail Your Life: The Auto Pro's Guide to Disability Insurance Godzilla’s Reign: Unpacking the Legend of the 5th Gen Nissan GT-R

Godzilla’s Reign: Unpacking the Legend of the 5th Gen Nissan GT-R Car Fuses: The Unsung Heroes of Your Electrical System (What They Do, Common Failures, & How to Replace)

Car Fuses: The Unsung Heroes of Your Electrical System (What They Do, Common Failures, & How to Replace) Protect Your Ride & Your Family: Why Northwestern Mutual Life Insurance Matters for Car Owners

Protect Your Ride & Your Family: Why Northwestern Mutual Life Insurance Matters for Car Owners Scout Motors: The American Icon Reborn for the Electric Age

Scout Motors: The American Icon Reborn for the Electric Age Unlock 200,000 Miles: The Ultimate Preventative Car Maintenance Schedule & Checklist

Unlock 200,000 Miles: The Ultimate Preventative Car Maintenance Schedule & Checklist How to Replace Wiper Blades: A Step-by-Step DIY Guide (Save Money & See Clearly!)

How to Replace Wiper Blades: A Step-by-Step DIY Guide (Save Money & See Clearly!) The Ultimate Guide to Cheap Car Insurance: Find Your Lowest Rates in 2025

The Ultimate Guide to Cheap Car Insurance: Find Your Lowest Rates in 2025 The 2025 Automotive Retirement Number: What Auto Pros Need to Save for a Comfortable Ride

The 2025 Automotive Retirement Number: What Auto Pros Need to Save for a Comfortable Ride Pre-Purchase Inspection (PPI): Your Essential Checklist Before Buying Any Used Car

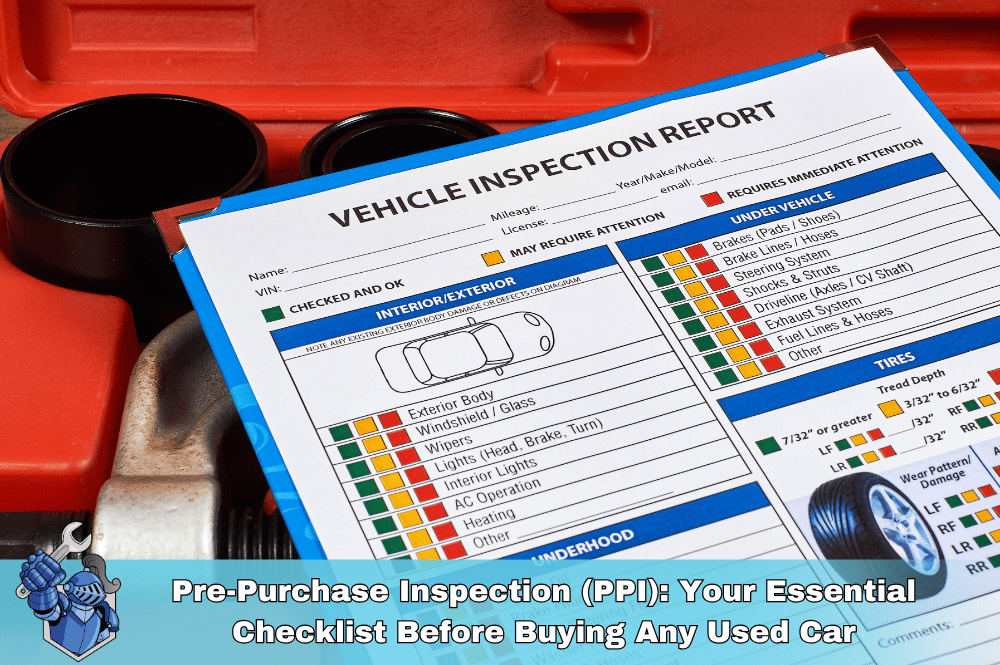

Pre-Purchase Inspection (PPI): Your Essential Checklist Before Buying Any Used Car Unearthing Automotive Gold: The Underrated Used Cars You Need to Buy Now

Unearthing Automotive Gold: The Underrated Used Cars You Need to Buy Now The Last Ride: Why the 2025 Audi A4 is the Ultimate Collectible (and Daily Driver)

The Last Ride: Why the 2025 Audi A4 is the Ultimate Collectible (and Daily Driver) 2025 Corvette ZR1: The Ultimate Guide to Specs, Price, and Performance

2025 Corvette ZR1: The Ultimate Guide to Specs, Price, and Performance Headlight Restoration & Bulb Replacement: The Ultimate Guide to Perfect Car Lighting

Headlight Restoration & Bulb Replacement: The Ultimate Guide to Perfect Car Lighting Does Driving for Uber/Lyft/DoorDash Void Your Car’s Warranty? & How to Get Covered

Does Driving for Uber/Lyft/DoorDash Void Your Car’s Warranty? & How to Get Covered The Ultimate Guide to Motorcycle Extended Warranties: Is It Worth It for Your Ride?

The Ultimate Guide to Motorcycle Extended Warranties: Is It Worth It for Your Ride? 2025 BMW X7 vs. Mercedes-Benz GLS: Which Luxury SUV Reigns Supreme?

2025 BMW X7 vs. Mercedes-Benz GLS: Which Luxury SUV Reigns Supreme? Blown Head Gasket: The $2,500+ Repair Nightmare That Catches Car Owners Off Guard – Learn How to Prepare

Blown Head Gasket: The $2,500+ Repair Nightmare That Catches Car Owners Off Guard – Learn How to Prepare Barbie's Dream Car: The Ultimate EV Conversion? (And Why Even Fantasy Needs a Real Warranty)

Barbie's Dream Car: The Ultimate EV Conversion? (And Why Even Fantasy Needs a Real Warranty) 2025 Cadillac Lyriq Review: The Ultimate Luxury Electric SUV?

2025 Cadillac Lyriq Review: The Ultimate Luxury Electric SUV? Pep Boys: Your Complete Guide to Auto Parts, Service & Repair (2025 Edition)

Pep Boys: Your Complete Guide to Auto Parts, Service & Repair (2025 Edition) 2025 Harley-Davidson Sportster S: The Ultimate Review & Buyer’s Guide

2025 Harley-Davidson Sportster S: The Ultimate Review & Buyer’s Guide Drive Smarter: Unlock Vehicle Protection with 0% APR Service Contract Payments

Drive Smarter: Unlock Vehicle Protection with 0% APR Service Contract Payments New Jersey Car Insurance Laws 2025–2026: Your Essential Guide to What’s Changed & What’s Next

New Jersey Car Insurance Laws 2025–2026: Your Essential Guide to What’s Changed & What’s Next The Ultimate Dodge Viper Guide: All Generations, Specs, & History (1991–2017)

The Ultimate Dodge Viper Guide: All Generations, Specs, & History (1991–2017) The Connected Car’s 'Black Box': How Your Data Impacts Warranty Claims

The Connected Car’s 'Black Box': How Your Data Impacts Warranty Claims 2025 Porsche Taycan: The Ultimate Guide to Porsche's Electrifying Evolution

2025 Porsche Taycan: The Ultimate Guide to Porsche's Electrifying Evolution Automatic vs. Hand Wash: Which is Truly Safer for Your Car's Finish?

Automatic vs. Hand Wash: Which is Truly Safer for Your Car's Finish? The Ultimate Toyota RAV4 Guide: Every Generation Explored (1994–Present)

The Ultimate Toyota RAV4 Guide: Every Generation Explored (1994–Present) Meineke Oil Change: Everything You Need to Know (Prices, Packages, and Why It Matters)

Meineke Oil Change: Everything You Need to Know (Prices, Packages, and Why It Matters) Erie Auto Insurance Review 2025: Rates, Discounts, & Why Drivers Choose It

Erie Auto Insurance Review 2025: Rates, Discounts, & Why Drivers Choose It Homeowners Insurance vs. Home Warranty: A Clear Breakdown for Every Homeowner

Homeowners Insurance vs. Home Warranty: A Clear Breakdown for Every Homeowner The Ultimate Bentley Bentayga Buyer’s Guide: Every Model, Trim & Real-World Ownership Costs

The Ultimate Bentley Bentayga Buyer’s Guide: Every Model, Trim & Real-World Ownership Costs The Ultimate Lamborghini Urus Buyer's Guide: Every Generation, Model, & What You Need to Know Before Owning

The Ultimate Lamborghini Urus Buyer's Guide: Every Generation, Model, & What You Need to Know Before Owning Mazda6 Generations Explained: A Complete History & Buyer's Guide (All Models)

Mazda6 Generations Explained: A Complete History & Buyer's Guide (All Models) The True Cost of Luxury Car Repair: Are You Paying Too Much Without a Vehicle Service Contract?

The True Cost of Luxury Car Repair: Are You Paying Too Much Without a Vehicle Service Contract? Chubb Auto Insurance: The Premier Choice for Luxury, Exotic, and Classic Cars

Chubb Auto Insurance: The Premier Choice for Luxury, Exotic, and Classic Cars Full Tort vs. Limited Tort in Pennsylvania: Which is Right for You? (A Driver's Definitive Guide)

Full Tort vs. Limited Tort in Pennsylvania: Which is Right for You? (A Driver's Definitive Guide) Don't Get Ripped Off: Your Complete Guide to Smart Car Repairs

Don't Get Ripped Off: Your Complete Guide to Smart Car Repairs Cash vs. Car Loan: Which is Right for Your Next Vehicle Purchase?

Cash vs. Car Loan: Which is Right for Your Next Vehicle Purchase? The New Land Rover Defender: Redefining Rugged Luxury (Your Ultimate Review & Buying Guide)

The New Land Rover Defender: Redefining Rugged Luxury (Your Ultimate Review & Buying Guide) The Silent Killer: Why Not Driving Your Car Wears It Out Faster Than You Think

The Silent Killer: Why Not Driving Your Car Wears It Out Faster Than You Think Beyond the Basics: Unpacking AIG's Elite Auto Insurance for High-Net-Worth Drivers

Beyond the Basics: Unpacking AIG's Elite Auto Insurance for High-Net-Worth Drivers The Ultimate 2025 Hyundai Santa Fe Review: Your Complete Buyer’s Guide

The Ultimate 2025 Hyundai Santa Fe Review: Your Complete Buyer’s Guide The Repair Shop Rejection Reflex: Why Customers Say No to Essential Car Fixes

The Repair Shop Rejection Reflex: Why Customers Say No to Essential Car Fixes Rolls-Royce Cullinan Review: Is This the World's Ultimate Luxury SUV?

Rolls-Royce Cullinan Review: Is This the World's Ultimate Luxury SUV? Amica Auto Insurance Review 2025: Unpacking Value, Dividends, and Why It Consistently Ranks #1 for Service

Amica Auto Insurance Review 2025: Unpacking Value, Dividends, and Why It Consistently Ranks #1 for Service Get Your Price Instantly: The Smart Way to Buy & Manage Your Car's Extended Warranty Online with NobleQuote

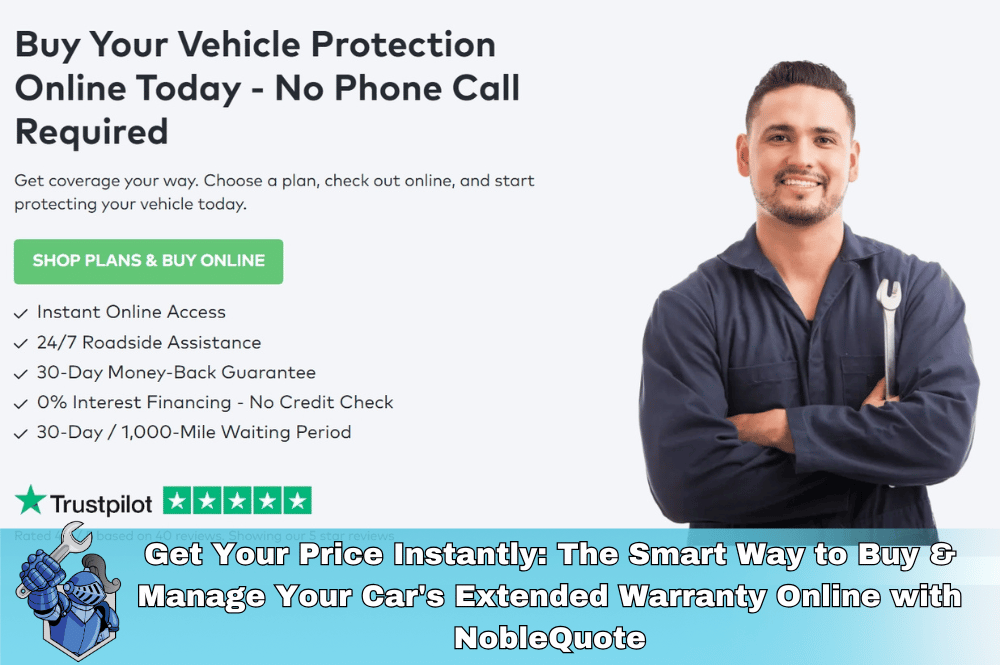

Get Your Price Instantly: The Smart Way to Buy & Manage Your Car's Extended Warranty Online with NobleQuote Rideshare Safety Unlocked: The Ultimate Guide to Secure Uber & Lyft Rides

Rideshare Safety Unlocked: The Ultimate Guide to Secure Uber & Lyft Rides The Ultimate 2025 Nissan Armada Buyer's Guide: Everything You Need to Know

The Ultimate 2025 Nissan Armada Buyer's Guide: Everything You Need to Know The Ultimate Guide to Home Warranty Plumbing Coverage: What's Covered, What's Not, and Why It Matters

The Ultimate Guide to Home Warranty Plumbing Coverage: What's Covered, What's Not, and Why It Matters The End of an Era: Why the Nissan Titan Was Discontinued (And What It Means for Truck Buyers)

The End of an Era: Why the Nissan Titan Was Discontinued (And What It Means for Truck Buyers) Drive: The Ryan Gosling Movie That Defined a Generation of Car Culture

Drive: The Ryan Gosling Movie That Defined a Generation of Car Culture CAN Bus Explained: How Your Car's Digital Network Connects Everything (and Why It Matters)

CAN Bus Explained: How Your Car's Digital Network Connects Everything (and Why It Matters) The Ultimate Guide to the 2025 Jaguar F-Pace: Performance, Luxury & Value

The Ultimate Guide to the 2025 Jaguar F-Pace: Performance, Luxury & Value Confessions of a Car Salesperson: What They Don’t Want You to Know (And How to Use It to Your Advantage)

Confessions of a Car Salesperson: What They Don’t Want You to Know (And How to Use It to Your Advantage) Water Damage & Your Home Warranty: Understanding What's Truly Covered (and What Isn't!)

Water Damage & Your Home Warranty: Understanding What's Truly Covered (and What Isn't!)